As we mentioned in a previous article, there are three objectives of a budget: (i) contribute to economic growth, through better allocation of resources, production of public goods and investment, and reduction of distortions in the economy; (ii) contribute to the cyclical stabilization of the economy, compensating for the gaps between global demand and supply; and (iii) contribute to a more equitable economy, through income redistribution and access of lower-income classes to public goods and a minimum income. There will also be other objectives or restrictions that the budget must pursue: (iv) stability of long-term public debt; and (v) administrative simplification and transparency, as well as (vi) respect for democratic freedoms and options. Let’s see, then, in a synthetic way, if the General State Budgets for 2025 respond to these objectives.

Today we will analyze whether the EO contributes to the economic stability of the economy (countercyclical policy), and to financial stability (public debt policy) and respects the new budgetary rules of the European Union.

1 Does the OE-25 contribute to stabilizing the economy?

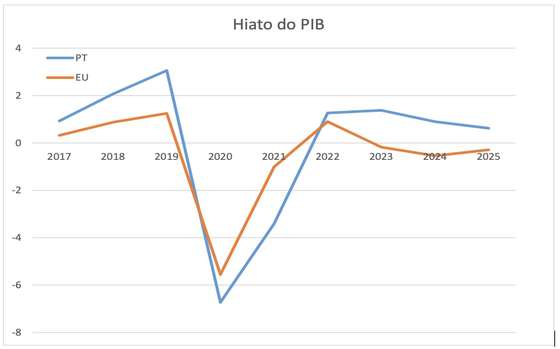

To study what the budget policy stance should be, that is, whether it should be expansionist, neutral or contractionary, we must resort to the product gap, which measures the ratio between current GDP and potential GDP, in percentage terms. If the production gap is positive it means that the economy is overheated, that is, there are symptoms of excess demand, if the gap is negative there are recessionary symptoms. As we can see in Figure 1, the European Commission estimates show a slightly positive gap for Portugal of around 0.6% of GDP, while for the EU an almost neutral value of -0.3% is estimated. As there is a low positive gap, fiscal policy in Portugal should be neutral in terms of cyclical impact.

Figure 1

Source: Ameco

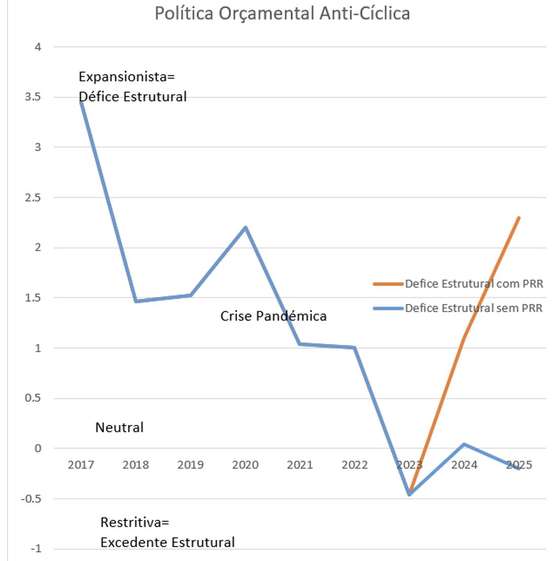

Now, if we look at Figure 2 we see that Fiscal policy in 2014 and 2015, which would be almost neutral without the PRR effect, is expansionary with the PRR effect.. This effect was already predictable, since the PRR was defined in a strongly recessive context of the pandemic crisis, but its implementation lasted for the next 3 to 5 years, clearly after the natural recovery of the cycle had occurred. Another synchronization error of the European institutions that Portugal is having difficulty correcting.

Figure 2

Source: Ameco. Note that the deficits are represented with a positive sign since they are expansive.

Three important observations that the reader should take into account. First of all, in macro terms, what matters is the overall budget balance, because it is what shows whether the State is injecting funds into the economy or not. Secondly, by defining a structural balance, we are already discounting the cyclical effect of the economy. For example, in 2020, the year of the pandemic, the deficit (State financing needs) was 5.8%, while the structural deficit was only 2.2% of GDP. Third, both the European Commission and the Public Finance Council (CfP) use the change in the structural deficit and not the deficit itself. In fact, during the 1977-78 crisis, some economists accused the IMF of causing a recession in Portugal because the budget deficit would have to fall from around 6 to 4% of GDP.

And what are the consequences of the expansionist policy? There will be some effects on inflation in Portugal, but as it is anchored by the ECB, they should not be significant. Excess demand will be channeled mainly into more imports with some impact on the external deficit.

We do not advocate an activist budget policy (that reacts to all movements in the GDP gap), so the expansionary impact of the OE-25 will not be valued significantly. On the contrary, what is worrying is the increase in current spending, and even primary current spending, which is expected to grow close to 10% in 2024, due to increases in social benefits and salary adjustments. And this increase only slows to around 6.5% in 2025.

2 Does OE-25 comply with European Union tax rules?

It may have gone unnoticed by many readers that the EU significantly changed the fiscal rules (formerly PEC) starting this year, under pressure from the Spanish socialists associated with the Netherlands, but with the support of many economists, including the IMF. Overall, the rules continue with the Treaty benchmark of 3% deficit and 60% debt, but are more relaxed in the short term. The new rules focus on the idea that the country must present a credible debt evolution framework, to avoid the risk of a crisis, and have the 60% ratio as a long-term objective (for countries like Portugal, the debt ratio must be reduced by 1% annually if it is above 90% and by 0.5% if it is between 90 and 60%). Based on this set of rules and studies of the evolution of the European economy, the Commission defines a maximum growth rate for public spending. The idea is that the rules should be simpler and, above all, by controlling spending, deficits should be limited. (Economic governance framework – Consilium). They also try to integrate reform measures and special treatment of investments and spending on climate transition and European security, defining net primary structural spending.

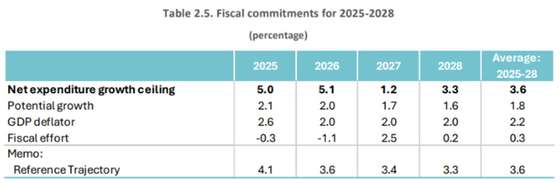

The Medium-Term National Budgetary-Structural Plan (2025-2028) (POEN-M) (available here) defines the budgetary commitments, reforms and investments undertaken by a Member State during a legislative period. This Plan was presented to the European Commission and must be approved by the European Council. The basic framework of macroeconomic projections (Table 1) shows relatively low potential GDP growth rates. The main commitment is the growth rate of Net Expense,[1] which is 5 and 5.1% in 2025-26, and then fall drastically to 1.2% in 2027 (the year in which the fiscal pressure is expected to increase by 2.5%), rising again to 3.3% in the last year of the legislature.

Just two notes: the GDP projections are clearly unsatisfactory and are well below the AD Program, revealing low ambition (is it prudence?) for growth. Secondly, and as we mentioned in a previous article, the increase in fiscal pressure is worrying, which will limit growth, as the Plan itself already foresees!

Table 1

Source: POEN-MP

According to the CFP Opinion on the OE proposal: “The State Budget Proposal for 2025 (POE/2025) corresponds to the first budget that must respect the commitment assumed by the Government for the evolution of net spending in the period 2025- 2028 in the medium-term National Structural Budget Plan (POEN-MP), presented to the European Commission and also subject to approval by the Council of the European Union. In the information elements that accompany the proposed OE Law, referring to the draft budget plan (PPP) that will be presented to the European Commission, it is noted that, in 2025, net spending will grow by 4.9% in nominal terms ( below the 5% commitment, but above the average value of 3.6% and the European Commission’s reference trajectory value of 4.1%). This matter will be included within the scope of the POEN-MP analysis that the CFP will publish.” (page 6).

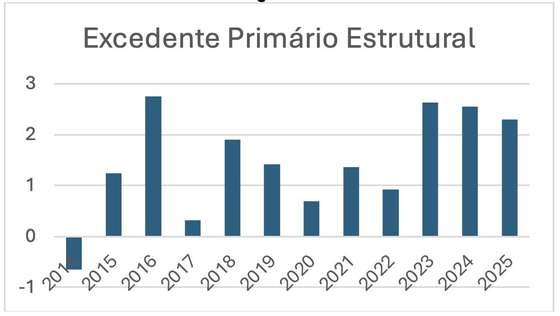

In terms of the trajectory of public debt, the OE-25 maintains, although slightly reduces, the structural primary surplus (Chart 3), therefore maintaining the downward trajectory of public debt (Chart 4):

Figure 3

Source: Ameco and OE-25

Figure 4

Source: Ameco and OE-25

In the OE-25 base scenario, the debt reduction is planned from 95.9% in 2024 to 93.3% in 2025 (the CfP even foresees a rate of 87.2% for this year, due to the revision of the national accounts by the INE and other effects) and then to 83.2% in 2028, at the end of the current legislature and to 77.3% in 2030. That is to say,A reduction of 3 percentage points in the debt-to-GDP ratio is expected, on average, well above the 1% required by EU rules.. At this point, the Government shows an ambition higher than the trajectory required by the EU. And, looking ahead, this progression will continue, despite the reduction in the primary surplus, which will create greater room for maneuver in debt reduction.

The OE-25 should have no problems passing the scrutiny of the European Commission. Most significantly, we are about to surpass the public debt threshold of 90% of GDP, which the Commission and several economists (and which we also defend) consider an important milestone in reducing the risk of a debt crisis.

3 Conclusions

The three main conclusions we draw from this article are: (i) SO-25 (and probably SO-26) will boost global demand (and not necessarily potential GDP) and should cause some acceleration in GDP (eventually higher than the projections of the government). This momentum is largely due to the acceleration of the (delayed) implementation of the PRR and increased transfers of EU funds. (ii) The increase in current spending in 2024 (10%) and that expected for 2025 (6.5%) remains worrying, well above the growth of nominal GDP (around 4.5%). And, to comply with European standards, the Medium Term Plan proposed by the Government foresees a sharp increase in the fiscal burden in 2027. (iii) Both the European Commission and the IMF have praised the very significant reduction in public debt, in terms of its weight in GDP, which went from 126% in 2017 to probably be below 90% in 2025. This reduction was largely due to the effects of nominal GDP growth (with great help of inflation), also reflecting the primary surpluses achieved by the different governments.

[1] Net Spending is equal to total Public Spending minus the expected revenue from discretionary tax increase measures. This rule allows discretionary increases in the tax burden without limit!

Source: Observadora