The summer of 2022 is poised to be a dangerous test for overburdened electricity grids around the world amid rising energy prices and dwindling fuel stocks due to the coronavirus pandemic and Russia’s invasion of Ukraine.

Bloomberg News He said on Monday that the global energy crisis was in full swing:

A heatwave in Asia has caused power outages for hours each day and put more than 1 billion people in Pakistan, Myanmar, Sri Lanka and India at risk without visible relief. Six power plants in Texas have offered some insight into what’s to come, as the summer heatwave began to arrive earlier this month. This summer, at least a dozen US states will face power outages, from California to the Great Lakes. Supplying electricity to China and Japan will be difficult. South Africa is preparing for a record year of power outages. And Europe is in a particular position, backed by Russia: if Moscow cuts gas supplies to the region, it could lead to cuts in some countries.

“War and sanctions are distorting supply and demand, and this is combined with severe weather and the post-Covid economic recovery that has increased demand for electricity,” said Shantanu Jaiswal, a BloombergNEF analyst. “Combining so many factors is a bit strange. I can’t remember the last time they were together. ”

This

In India, power outages in many states are approaching 2014 levels, where the country’s total product was estimated to have decreased by about 5%. This would mean a reduction of around $100 billion if the losses were more extensive and lasted a year. Power outages are likely to increase revenue in the electricity and fuel markets, increase electricity bills and increase fuel inflation. When stations hit the Texas grid this month, wholesale electricity prices in Houston briefly soared above the $5,000-per-megawatt-hour cap, which is 22 times the average amount of peak power delivered during the day.

This Tuesday, February 16, 2021, a photo file shows power lines in Houston, Texas. (AP Photo/David J. Phillip)

The US and Canada are not exempt from the crisis because their North American natural gas reserves are running out. Industry analysts have blamed the coronavirus pandemic on maintenance delays that can leave energy infrastructure fragile and vulnerable in bad weather.

The Midcontinent’s Independent Systems Operator (MISO), a network that serves 15 states with a total population of more than 42 million, warns that it has “insufficient” electricity generation capacity to meet high demand during the summer months. issued such a warning. . Customers in 11 MISO states have been notified that they may experience a power outage.

Heavy smoke rose from the Dixie Fire in the Plumas National Forest near the Pacific Gas and Electric Rock Creek power station in July. (Peter DaSilva/UPI)

“The US has more power outages than any other industrialized country in the world. About 70% of our network is about to end, Teri Vishwanath, economist at CoBank ACB, told Bloomberg News.

Delhi suffered a power outage on Tuesday due to heavy rain and strong winds. Power company officials said some of the outages were deliberately introduced as a safety measure, while others were caused by the storm’s destruction of power lines.

A woman walking in front of a power plant in Vinnitsa, Ukraine, on March 16, 2022. (AP Photo/Rodrigo USA)

The Bloomberg report has several times blamed “climate change” for increased energy demand, without providing any evidence to support the claim, while carefully avoiding the problems caused by reliance on unreliable “green energy” sources.

Fox News Even more tedious on Tuesday, Michigan’s power grid operators warned customers that the rush to switch to wind and solar could lead to power outages during the summer. Not only are these renewables vulnerable to the elements, but the rest of the aging power grid has some compatibility issues with the wind and solar farm.

Farm with solar panels from Cypress Creek Renewables on October 28, 2021 in Thurmont, Maryland. (AP Photo/Julio Cortez)

World Energy Council I said Last week, Russia’s invasion of Ukraine triggered an unprecedented “global energy shock” that caused oil prices to rise and supply chains disrupted.

Unlike previous energy shocks in the 1970s, this one came just after the Wuhan coronavirus pandemic, which devastated economies in developing countries. The World Energy Council noted that rising energy prices will increase inflation and make food and other essential commodities unaffordable. In parts of the Third World, summer blackouts will be more dangerous due to food and drug crises.

Wind turbines open the back of a solar farm in Rapsshagen, Germany, Thursday, October 28, 2021. (AP Photo/Michael Sohn)

A glimpse into this unsatisfying future is provided by Sri Lanka. suffering Partly due to fuel shortages, power cuts and the growing food crisis, the pandemic and Russia’s invasion of Ukraine dealt a devastating blow to an economy engulfed by a lifetime of irresponsible government spending, debt and corruption.

Oil prices are literally rising and fuel shortages are increasing murder Sri Lankans how to stop island Price increase imposed Fuel prices hit an all-time high this week to offset government books, threatening to worsen inflation as prices of nearly all goods and services rise.

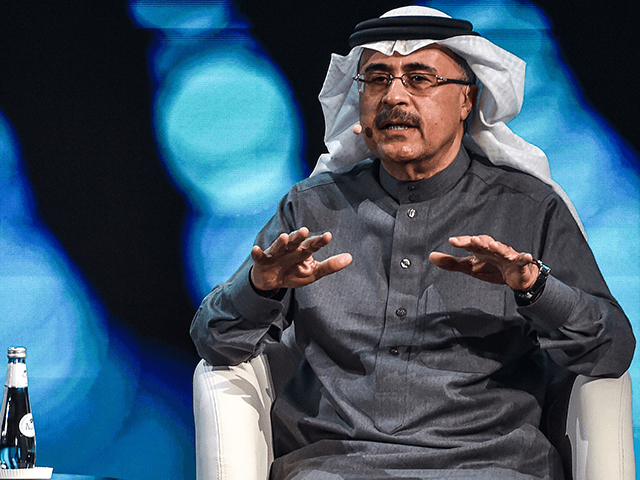

Amin Nasser, CEO of Saudi Arabia’s national oil company Aramco, showed another grim sign Tuesday. criticism He said some energy-intensive sectors of the global economy are just starting to recover from the pandemic, notably the aviation industry, which had an average fuel consumption of about 2.5 million barrels per day before the Chinese coronavirus.

Nasser also argued that oil companies are not in a good position to increase their production and refining capacity to meet growing demand because the move to clean energy has left them unwilling to invest in long-term fossil fuel projects.

“The pressure and rhetoric is, ‘Don’t invest, you’ll have orphaned property. It is difficult for managers to invest,” he explained.

Amin Nasser, President and CEO of Saudi Aramco, speaks at the Ritz-Carlton Hotel in Riyadh, January 27, 2021. (Getty Images via FAYEZ NURELDIN/AFP)

John Kerry, the Biden administration’s ridiculous “climate ambassador” lasted World Economic Forum (WEF), in Davos, Switzerland, Number. Meet growing demand by building more reliable energy assets, a position that ensures the fulfillment of the Saudi Aramco CEO’s prophecy of an unprecedented and uncontrolled energy shock.

“We can’t be persuaded to believe that he’s suddenly opened the door to go back and do what caused the crisis,” Kerry said, confident she wouldn’t face a power outage. He suffers from travel restrictions or dies of heat stroke because his air conditioner does not work in the summer.

US Presidential Special Representative on Climate Change John Kerry delivers a speech on stage as part of the United Nations Climate Change Conference COP26 World Leaders Summit, held in Glasgow, Scotland, on November 2, 2021. (via BRENDAN SMIALOWSKI/AFP Getty Images)

Another energy bomb that is about to explode is in China, which will soon begin to emerge from the latest restrictions on the dire coronavirus, with a corresponding increase in demand for industrial energy and transportation fuel.

Daniel Yergin, S&P Global Vice President I said He said on Tuesday that if the Chinese economy recovers strongly from lockdowns, with rising consumer demand and manufacturing, “it will actually increase global oil demand and put more pressure on the market.”

“This is actually going to make matters worse for the global economy and certainly exacerbate the problem of inflation that the world is currently struggling with,” said Yergin.

“The only thing that can drive prices down is a recession that nobody wants,” he added angrily.

Yergin at the WEF panel discussion in Davos on Tuesday I said The impending global energy crisis is so severe that “memory loss for energy security has been stifled” – in other words, a fearful population requires greater access to proven energy, while good plans for the forced transition to a smaller green economy are set aside. resources.

Yergin’s group noted that some of this renewed interest in energy security is the result of China’s disobedience. planting coal mountain and buy everything oil properties can survive without caring about the problems of the climate change movement.

The rest of the world realized that Beijing did not want to risk the strength of its industry due to the loss of power caused by the switch to wind and solar power. A major global energy crisis this summer is likely to fuel that interest even more, as inflation rises and living standards fall in the Western world.

Source: Breitbart