With some central banks, including the European Central Bank (ECB), resorting to raising interest rates to try to control inflation, some are choosing Google Maps to show your concern about the economic situation.

At first glance, this would not be the most automatic place to leave messages for monetary policymakers, notes Bloomberg, which reported on this curious trend. The phenomenon is quite visible in the evaluations carried out at the ECB’s own headquarters, in Frankfurt, Germany.

In a more consensual use, these assessments made on Google Maps focus on more practical aspects, such as the architecture of the building, accessibility and the quality of the supporting infrastructure. In the case of the ECB building, a different word that is frequently mentioned already stands out: inflation.

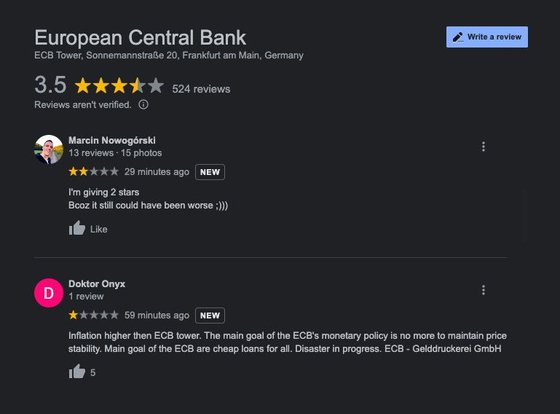

At this time, the The ECB tower has a total of 524 ratings, reflecting a 3.5 star rating at the time of writing. The 45-story glass tower, located in Germany’s main financial center, was completed in September 2012, but Mario Draghi, then president of the European Central Bank, officially opened it in 2015.

Nearly ten years after the building opened, the rating has been slipping in recent months, Bloomberg data shows. Although Google leaves a warning that reviews are not verified (but are removed if false content is identified), it is possible to see from the dates that many of the one-star reviews coincide with the interest rate hike announcement by Google. of the led organization. by Christine Lagard.

Bloomberg even establishes a relationship between the ECB’s tower rating and the rate of inflation. Since 2016, the building has maintained a stable rating above four stars. In 2021, when the uptick in inflation began to be felt, the rating was lowered slightly. This year, with eurozone inflation at its highest level since the creation of the single currency (July’s advance points to a rate of 8.9%), the rating has suffered a much more significant drop.

Excluding this Friday’s comments and ratings, which may be linked to Bloomberg news, there are at least 30 one-star ratings made in the last two months.

Lagarde’s “take it over there, give it over here”. To avoid another debt crisis, the ECB may raise interest rates faster

“I just want to thank the ECB. Thank you for the high inflation you caused”, can be read in a comment from a star made two months ago. “Are you happy with the price increase?” asks another user, who also gives the building only one star. “Brazen monetary policy,” another Google Maps user writes, noting that “the ECB is trying to fight a forest fire with a water gun.” The same user also accused the ECB of “having an audacity that has no end”.

“Inflation higher than the ECB tower”, one user wrote this Friday. “The main objective of the ECB’s monetary policy is only to maintain price stability.” “It’s an ongoing mess,” continued this user, who also left a one-star review.

The ECB is not the only central bank raising interest rates: the US Federal Reserve and the Bank of England have also raised them. Precisely this Thursday, Governor Andrew Bailey announced the largest increase since 1995, of the order of 50 basis points. However, the British are being much more restrained in their comments on the Bank of England building on Google Maps.

The building has a rating of 3.9 stars out of a maximum of five stars. This building in London has a total of 350 views. Interestingly, much of the criticism of the British central bank is linked to the exchange of banknotes and the service provided during these exchanges. There is also room for several positive criticisms of the architecture of the building, where this financial institution has been installed since 1734.

The Bank of England accelerates the rate hike. It had been 27 years without raising interest rates or 0.5 points

The Federal Reserve does not escape the “reviews” of critics either

Across the Atlantic, the “heart” of the US Federal Reserve, which dictates monetary policy for the world’s largest economy, is on Constitution Avenue in Washington DC. Here is the building of the Government Board of this central bank. And, like the ECB, the fields that allow comments on the building in Maps are also receiving feedback that goes beyond the issue of accessibility or the architecture of the building.

United States Federal Reserve Building in Washington.

“The Federal Reserve is ruining our economy and status in the world,” one user wrote a week ago, giving only one star. In this survey, which registers a total of 87 reviews, with a total of 2.7 stars, there are at least 11 one-star reviews made in the last seven months.

The keywords most associated with the valuations of this Fed building are “currency”, “bank”, “economy”, “building”, “printing” or “politics”, the latter alluding to monetary policy.

The Fed, led by Jerome Powell, announced at the end of July an interest rate hike of 75 basis points, a return to pre-pandemic levels. This was the fourth consecutive rate hike by the Fed to control US inflation, which reached 9.1% in June.

Inflation in the US market is at levels of more than 40 years, since you have to go back to November 1981 to find such a high rate. Rising fuel and energy prices have been the main contributors to rising inflation.

US inflation figures for July are due out next week on August 10. Economists’ estimates point to a stabilization of the consumer price index, again pointing to a value above 9%.

Fed interest rates return to pre-pandemic levels. “Extraordinarily large” increase (75 basis points) may continue

Source: Observadora