you never come

Professor of economics at the Universidade Lusíada

Former Vice President of the Board of Directors of the Social Security Financial Management Institute

September 6, 2022

The Prime Minister announced the “Families First” Program, which comprises a set of eight additional measures called family income support in a context of a sharp increase in the cost of living. In total, the package is worth around €2.4 billion. To give you an idea, it is not enough to spend two months with only two months of pension (not counting those from Caixa Geral de Aposentações).

One of the most emblematic measures is the assignment of an “extraordinary supplement equivalent to half a month’s pension. This extraordinary measure will be paid all at once in October.” Anyone who hears such a thing imagines a pension bonus in October. No counterparts. It turns out that this will not be the case, as several political parties, journalists and other agents immediately identified. For 2023, Costa also announced measures. One of them, much less comprehensive, is to set, from now on, the rates for updating pensions, replacing the current law (in fact, it will propose to Parliament that it do so, which will result in the same thing, given the current situation). context of absolute majority).

The idea is complex for ordinary pensioners, but basically it can be said with certainty that the Government will give pensioners, in October 2022, what it will take away from them later, in 2023. That is, it will only change the schedule of expenses, bringing the value of the half pension to each pensioner to October 2022, subtracting it throughout 2023, by granting pension increases that will be only about half of what pensioners would be entitled to if the law were applied.

The explosive power of the Law

In 2006, Law No. 56-B/2006 was published, creating the Social Support Index (IAS) and defining the new rules for updating pensions. After its successive modifications, it defines three pension brackets: less than €886 (or 2 IAS); between €886 and €2,659 (between 2 and 6 IAS); greater than €2,659. Of course, for reasons of fairness, the update rule is more generous the lower the pension bracket.

To define the increases for each year, there are two determining variables. The first is the average (real) growth rate of GDP in the two years prior to the year for which the increase is defined (with minor technical nuances that are not relevant in this context). The idea is to capture the magnitude of the increases above inflation that the country will be able to withstand given its recent capacity to create wealth. The second variable is the average inflation rate (without the housing component) during the year prior to the pension increase (again, with minor nuances irrelevant to the case). The increases in pensions in January of each year will be dictated by the combination of the evolution of these two variables, exactly in the terms of Law No. 56-B/2006.

The central issue is that, since the law entered into force, increases as high as for 2023 have never been expected. In fact, the economy registered growth levels typical of a post-pandemic period, but very abnormal in the context Portuguese. Taking into account the most recent forecasts of the Bank of Portugal for GDP growth in 2022 (6.5%), we could reach an average of 5.7% in the last two years. To top it off, inflation is reaching frightening levels, with an annual average forecast of close to 7% by the end of this year. A simple simulation suggests that, if nothing were done, public spending on Social Security pension increases alone in 2022 could reach €2 billion, which would be catastrophic and unaffordable for the 2023 budget, one might say. Now, given the slack in 2022, with the execution of tax collection well above what was expected (due to inflation), the Government chose to allocate part of the pension increases that would only occur in 2023 to 2022, making a real two in one -mitigates budgetary pressure for 2023, taking advantage of the budgetary slack generated in 2022; and gives the impression that it is actually giving money to pensioners, generously giving them an ‘extraordinary supplement’ of half board. Obviously, there is no bonus or offer, since the effect in 2023 is, of course, a reduction in spending on pension increases by approximately half of what would have occurred if this measure had not been adopted.

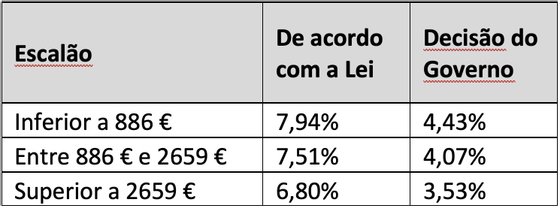

For example, a low pension (1st level) should increase by almost 8% in 2023. But it will only increase by 4.43%. A 2nd tranche pension (between €886 and €2,659) would increase by 7.51% in 2023. With this measure, the increase will be limited to 4.07%. Finally, one of the highest pensions should increase by 6.8%, but will remain at a 3.53% increase.

Pension update rates for 2023

doctor

The Government justifies the compensation to be made in 2023 with the need to “guarantee the fair balance between the protection of the purchasing power of pensioners and the sustainability of Social Security”, implicitly recognizing that the law had not been designed for extraordinary situations such as the one that we live today. And well, in my opinion. The decision is responsible and sensible. What does not make sense is to convey the idea that something is happening, integrating this measure into a cake of 2.4 billion euros to help citizens, when that is not the point.

Let us see that, as mentioned, the measure is approximately neutral in the pocket of pensioners, taking into account the 2022-2023 biennium. A pensioner with a pension of €500 will receive €750 in October (plus €250). If the law were applied normally, the monthly increase in January 2023 would be €40. As the Government will set the rate of increase, this increase will be limited to €22 per month. The pensioner will receive a total of €7,310 in 2023, when he would have received €7,556 if there had been no anticipatory measure in October. In the total of the two years, as seen in the table, the amount received will be approximately the same.

doctor

So that the memory is not erased

In 2011, when he came to power, Passos Coelho found himself in a delicate situation in terms of public accounts, with the challenge of executing an ambitious and very tough program of economic and financial adjustment. One of the measures found in the memorandum of understanding negotiated and signed by José Sócrates with the Troika was precisely to suspend the rule of automatic updating of pensions. Measure 1.12 referred precisely to the following: “Suspend the application of pension indexation rules and freeze pensions, except for the lowest pensions, in 2012”. That is what the government did. The application of Law No. 56-B/2006 was suspended, and the increases were defined through successive State Budget laws, without any link to inflation or economic growth. Alternatively, the criterion adopted was the combination of maximum social justice with the financial capacity of the country (which was quite weak, as we know). For that reason, the general rule was to increase only the minimum pensions, on average, around 1% per year. In 2015, these increases weighed around 96 million euros in Social Security spending.

When Costa came to power in November 2015, he immediately tried to implement what he called the “unfreezing of pensions.” But what did the government actually do? He ended with the suspension of the application of the Law, which had been in force during the years of the Troika. At first glance, it was a very fair measure, taking advantage of the improvement in the economic context left by the PSD/CDS government. But, after all, it was just another hoax, a mere optical illusion. Costa, in his good way, did nothing but save money, giving the impression that he was unfreezing pensions. One of the biggest farces we have seen in national politics. And the most serious thing is that the idea passed with great efficiency. What happened was the following: the minimum pensions, the only ones that increased with Passos Coelho, are all included in the lowest scale, naturally. At this level, most pensions are minimal. This is a very asymmetric group, with a large proportion of minimum pensions and a smaller proportion of pensions above the minimum (these, although reduced, did not increase). As I mentioned earlier, these augmentations cost almost €100 million a year. Here comes António Costa and the contraption. Unfreeze the effects of the law. What he didn’t explain was that this was the best time to do it, because he would spend much less than Passos Coelho! GDP grew very weakly (0.8% in 2014 and less than 1.8% in 2015), and inflation was just above zero. After all, with the application of the law, the increases would only cost around 50 million euros, about half of what Passos Coelho spent. But it doesn’t stop here. Given the combination of economic variables with the provisions of the Law, only first-tier pensions increased a “fantastic” 0.4%. Now, it is easy to see the deception. About 70% of first-tier pensioners (those with minimum pensions) were used to increases of 1%. With Costa they now have a magnificent 0.4%! The other 30% of first level pensioners also had 0.4%. As for the rest of the second and third step pensioners, who had their pension frozen during the years of the Troika (by decision of the Government), they continued with their pension frozen in 2016 (by application of the law, which Costa unfroze). Magnificent!

António Costa achieved a blow of illusion in his own image. He gave the idea that he was replacing something, but in reality he was saving money compared to the previous year. Deep down, he was even being “sweet”, the law was to blame! More or less similar to what you are doing now. Only, instead of suspending the law, it only adjusts the payment schedule to the situation of public finances, transferring to 2022 expenses that would only occur from January 2023.

It is therefore false that there is now any measure to increase spending on pensions to support the fight against inflation. It’s just another fallacy!

Source: Observadora