As of this Saturday, July 1, the new withholding tables are in force, whose objective is to bring the amount withheld closer to what is actually owed, based on a marginal rate. For salaries of 850 euros or 900 euros (singles with a dependent), the net profit can reach 5%, according to simulations from the Ministry of Finance released this Friday. But if the amount withheld each month decreases, the return in the following year will be less.recognized by the government.

In a statement, Fernando Medina’s ministry explains that the new model intends, on the one hand, that an increase in gross salary “always corresponds to an increase in net income at the end of the month” and, on the other hand, to ensure a closest approximation of the amount of tax withheld to the amount paid by the IRS. This will allow taxpayers to “dispose of the income that is theirs now, instead of waiting for the refund” that only happens later. In other words, as the Treasury acknowledges, the following year “there will be fewer adjustments to make.”

The ministry guarantees that “for the majority of taxpayers”, the new tables will result in an “increase in monthly net income” compared to the first half of the year.

The minimum wage in the State begins to withhold the IRS on a monthly basis, but can return to the exemption in July. See the simulations

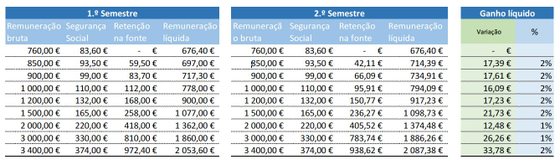

Single without dependents

For lower income singles without dependents, the net gain may be 2%. For example, with a salary of 850 euros gross, that means an additional 17.39 euros per month, while a salary of 900 euros will have an additional 17.61 euros per month in the account. Already a worker who earns 1,500 euros gross can expect to see the salary that comes to her account rise every month to 21.73 euros.

For those who earn 3,000 euros gross, the monthly net profit is 1%, which means 26.26 euros more, below the 33.78 euros earned by those who receive 3,400 euros gross (a profit of 2%).

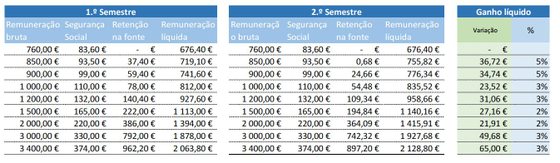

Single with a dependent

In the case of singles with a dependent, in the government simulations, salaries of 850 euros and 900 euros have net gains of 5% —in the first case, with an additional 36.72 euros per month and, in the second, with an additional 34.74 euros. Now, for example, a salary of 1,000 euros gross can expect to have 23.52 euros more in the account each month, 3% more than in the first semester.

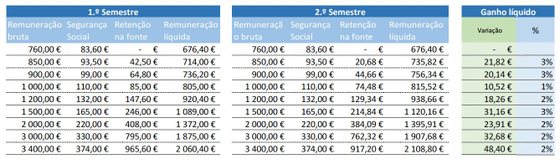

Married, two owners, with a dependent

In government simulations for these cases, the net profit can range from 10.52 euros (1%) on salaries of 1,000 euros to 48.4 euros (2%) on salaries of 3,400 euros. On a salary of 850 euros, the profit will be 21.82 euros (3%), a value that drops slightly to 20.14 euros (also 3%) in the case of a salary of 900 euros.

Source: Observadora