“Our method is very simple. We look for businesses with exceptional economic fundamentals, run by capable and honest people, and we try to buy them at reasonable prices.”

Warren Buffet

The S&P500 is going through its worst start to the year since 1939, down around 20%. The Nasdaq is down 30%. Financial markets have been hit by waves of uncertainty triggered by a series of events including the war in Ukraine, lockdown measures in China, rising inflation and the possibility of rising interest rates. These factors contribute to fears that the global economy is headed for a recession.

This turmoil in the markets leaves few places where investors can take refuge or avoid losses. Bond indices fell in line with equity indices as investors discounted the possibility of an interest rate hike. The Bloomberg Global Aggregate Index, a benchmark for corporate and government debt, has fallen about 10% in euros since the beginning of the year, its biggest correction in 20 years.

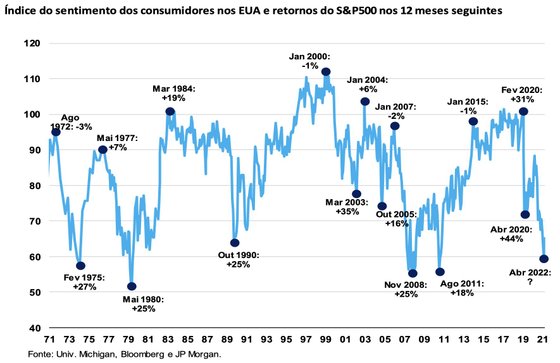

It is widely documented that the markets (investors) do not like uncertainty and most of us are not programmed to deal with it. The US consumer confidence index has fallen sharply this year, reaching one of the lowest levels in 50 years. It is during periods of extreme pessimism that we tend to find the best investment opportunities. In fact, history shows that investing in periods of extreme pessimism produces good returns. Basically, buy the pessimists and then sell to the optimists.

doctor

However, money continues to lose value as the cost of living increases. Although many know this, they are mostly in cash, waiting. The mistake they made at the start of the pandemic is being repeated: they are not taking the opportunity to buy exceptional quality companies that have had very strong corrections and have a long history of being highly profitable businesses operating in multiple economic cycles. They are money-makers, with strong balance sheets, powerful brands, loyal customers across geographies, strong competitive advantages, and significant pricing power.

Warren Buffett often repeats that “in the short term, the market is a voting machine, but in the long term, it is a balance”. What Buffett means is that, in the short term, markets don’t care about the economic fundamentals of business. In other words, to participate (in such a voting machine) all you need is money and no knowledge or emotional stability is required. In periods of uncertainty, investors are often driven by their emotions and are quick to hit the sell button when they are scared.

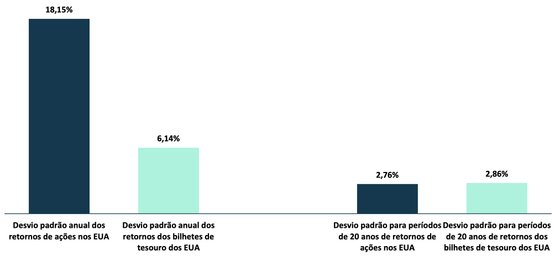

In the short term, anything can happen in the financial markets. Investing for a year or two in company stock can be extremely risky. The chart below shows that while stock markets are up most of the time, annual stock returns can be very volatile: we may have a 20% or 30% return, or see our investment reduce by the same amount.

doctor

In the long run, however, a company’s share price reflects the true value of its business and the wealth it generates for those who own this “piece” of the business.

In the 2015 letter to shareholders, Warren Buffett highlights the advantage that individual investors can have if they invest for the long term, warning that investing in bonds or having money tied up creates the “false” illusion of security. We could not agree more with this opinion. Over 20-year periods (see chart) there are no negative returns on stocks, but contrary to what might be expected, bonds did have negative returns.

For long-term investors, stocks are less volatile than they seem

According to studies by Jeremy Siegel and Robert Thaler, summarized in the chart below, the standard deviation of annual returns on US stocks between 1801 and 1995 is 18.15% vs. 6.14% for bills US Treasury This study shows that, in the short term, stock returns are more volatile.

However, over 20-year intervals, the standard deviation of US stock returns is actually lower than that of Treasury bills: 2.76% vs. 2.86%. This despite equities achieving an annual return of 10.1%, compared to 3.7% for Treasury bills.

Standard Deviation of Stock Returns and US Treasury Bill Returns

(period from 1801 to 1995, study by Siegel and Thaler)

We made it clear that short-term equity risk should not be overlooked, especially given the turbulence we have seen in recent weeks and months. This analysis, however, shows that, over long periods of time, stocks can guarantee better returns and be less risky than bonds.

Only the best companies serve

“Time is a friend of good business.”

Warren Buffet

The Value Investment philosophy aims to invest in high-quality businesses with good management teams and to buy them at reasonable prices. What does it mean? It means investing in companies with strong competitive advantages, managed by capable people, with attractive long-term growth opportunities and strong balance sheets to support that growth. It is very important to keep in mind that nothing is worth an infinite price and always keep in mind that price is what we pay and value is what we receive. What we seek is to receive more than what we pay, ensuring that we invest with a safety margin.

This approach means that a value investing philosophy and sound decision processes will deliver better returns than most.

Over a long enough time horizon, the performance of companies’ stock prices will reflect underlying earnings growth. We remind you that this process requires patience and the ability to tolerate short-term fluctuations. Sometimes the market value can seem disconnected from its true value.

For this reason, in addition to a value-oriented philosophy of quality business, it is essential to draw up a long-term investment plan and have the patience to wait for the results. There is no beauty without but. Everything has a price and, in this case, the price is the volatility that we have to endure to obtain these returns, clearly above other asset classes.

We must not give in to emotions that lead us to sell and wait for calmer days. Unfortunately that day will never come, there will always be some challenge that will make us wait for tomorrow to invest again. The experience of great investors like Seth Klarman says that when we don’t buy low, it is much more difficult to buy high. This is because equity markets start to rise long before we get good news about the economy and investors are more bullish. Big recoveries happen very fast and many are left out waiting for setbacks, which when they happen, are a kind of justification for being out and the idea of ”getting in” is left aside again. These stories are repeated over and over again.

Accepting market setbacks is the price of a successful investment

Why do so many avoid paying this price? The natural response of someone who sees their investment account drop with each passing day (even if it’s just on paper) and sees that drop as a penalty is to try to avoid future penalties. Trivial as it may seem, viewing market volatility as a cost and not a penalty is an important part of developing the mindset that allows us to stay in the market long enough for investment gains to materialize and grow.

Maybe an example will help. Tickets to Disneyland are around 100 euros, but in return we spend a day with our children that we will never forget. In 2019, around 156 million people thought it was a price worth paying. These people could have stayed home and had fun for free. But it was not the same.

Returns in the stock market are also not free, and never will be. In the same way that we are not forced to go to Disneyland, we are also not forced to pay the price of always being invested (despite the volatility). But generally speaking, we get what we pay for.

Volatility, the price of returns, is the admission cost to achieve above-average returns from cheap parks (deposits, bonds, or liquidity maintenance).

The key is to convince yourself that it is worth paying the market cost. This is the only way to deal with volatility and uncertainty: not just tolerate it, but realize that it is a cost of admission worth paying. This is the price of a successful investment.

“Only if we look beyond the short-term crowd can we hope to do better.”

Nick Sleep, Nomad Investment Partners

Therefore, for investors, and because discipline should not be seasonal, it is important to:

- Invest in companies of exceptional quality, with strong competitive advantages that are difficult to replicate, with solid pricing power and balance sheets, with the ability to grow in the global market and managed by proven teams aligned with shareholders,

- See market fluctuations as opportunities to buy great deals that are rarely cheap.

- Don’t let these fluctuations throw you off the “track”. What really matters is the long-term focus and intrinsic value of the portfolio in which they are invested, not their day-to-day performance.

In the long run, investing in stocks outperforms investing in cash or bonds by a wide margin. However, we must be aware that it does so with much higher short-term volatility.

Our “risk”, therefore, is inversely correlated with our investment horizon. The stock market can be very volatile in the short term, but it is the most consistent generator of wealth in the long term.

May 23, 2022

Source: Observadora