The Governing Council has scheduled a extraordinary meeting for this wednesday, an unusual initiative that will provide an opportunity for central bank officials to analyze recent volatility in financial markets. At the top of concerns is the rapid devaluation of the euro against the dollar and other currencies – a factor that, in itself, drives inflation – and also the pressure that has been generated in recent weeks on sovereign debt securities of the most indebted countries in the eurozone, including Italy and Portugal.

Although there are no more details about what the ECB may announce this Wednesday -if it will announce anything concrete-, the news of this emergency meeting has already caused a change of direction of the two movements. On the one hand, the euro returned to close to 1.05 dollars, with a rise of almost 1% that mitigated the recent heavy losses.

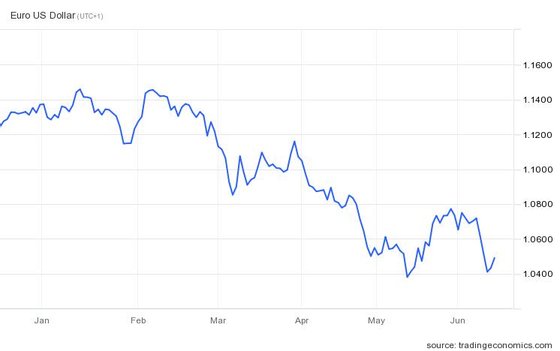

At the end of May, the euro was worth US$1.075, for example, and at the beginning of the year it was around US$1.15, a devaluation that has worried the ECB because it tends to aggravate the inflation generated by energy imports, of products that are denominated in dollars. The US bank predicted on Tuesday that the euro will reach parity against the dollar within a month, and the probable rise in interest rates that the Federal Reserve will announce this afternoon could accentuate this movement of devaluation of the euro against the dollar.

The euro is down around 10% against the dollar this year, due to the perception that the US Federal Reserve would be quicker and more aggressive than the ECB in raising interest rates. SOURCE: TradingEconomics

On the other hand, equally or more worrying for the ECB is that investors have been disappointed that Christine Lagarde has not been able to gather consensus at the last meeting of the central bank to announce some type of specific tool to deal with the possible rise in interest rates. interest rates (and divergence of implicit risk premiums) of the most indebted countries, such as Italy and Portugal.

ECB. Lagarde triggers inflation and awakens the “ghost” of the debt of countries like Italy and Portugal

About two weeks before the new purchases of public debt in the markets by the ECB officially ended, Christine Lagarde limited herself to guaranteeing that the ECB would have complete freedom to announce some type of instrument – be it precautionary or even, with concrete measures – intervention – that would ensure that the rise in interest rates did not create risks of fragmentation of monetary policy, which in simple terms means very different interest rates within the different countries of the euro area. But nothing was announced.

The ECB has also underlined that it will continue to flexibly reinvest any amounts the ECB receives from debt repayments and interest (for securities it has purchased over the years). However, he refuses to quantify exactly the “firepower” at stake, leading government bond market participants to speculate that indebted countries will find it more difficult to obtain the financing they need at a sustainable interest rate.

Interest rates in Portugal exceeded 3% and Italy’s 4%, reflecting a growing divergence with the financing costs of Germany, from which the markets ask for 1.7% to buy 10-year debt.

The emergency meeting of the ECB caused several changes in the programming of a public act that the Bank of Portugal promotes this Wednesday morning: the presentation, by Mário Centeno, of the quarterly Economic Bulletin in which the economic projections for this year and for the next. The press conference is now scheduled for 12:00 this Wednesday.

Source: Observadora