European shares fell early in the trading session, with investors’ attention focused on this week’s European Central Bank meeting and the development of the energy crisis in the region. Markets now expect the European Central to raise interest rates by 75 basis points during its upcoming Thursday meeting to reach 1.25%, after the region’s inflation hit a new record of 9.1% in August.

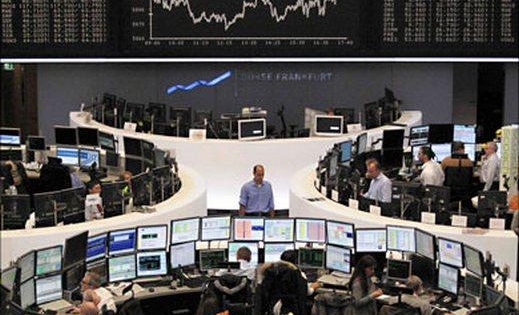

In terms of euro area economic data, Sentix Investor Confidence is scheduled to be released later today, as well as the final reading of the Services PMI, which is expected to be stable at 50.2 during August, in line with the preliminary forecast. reading. At the start of the session, the Stoxx Europe 600 fell 1.39% to 410 points at 10:09 am sharp Beirut time, while the UK FTSE fell 0.84% to 7219 points.

The German DAX index fell 1.77% to 12,820 points, while the French CAC index fell 1.95% to 6046 points. The euro fell 0.42% against the dollar to 99.09 cents, trading near its lowest level since 2002.

Source: El Iktisad