Follow here the liveblog about the Ukraine War

The euro fell this morning to below $0.99, the single currency’s worst rate since 2002, with uncertainty over Europe’s energy supply weighing on currency market optimism about the European economy.

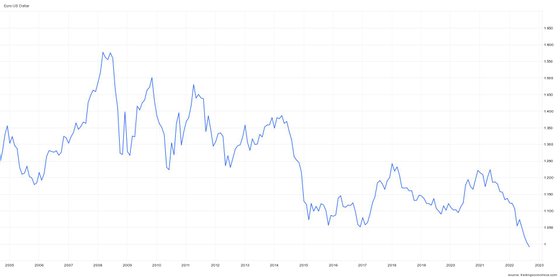

After having reached parity against the dollar in mid-July, the single currency is still unable to outline a recovery and this Monday fell to 0.988 dollars. The trend is in line with the losses of the stock markets this Monday, still resentful of the suspension of the Nord Stream 1 gas pipeline – which was believed to resume operation on Saturday, at 20%, but ended without reopening due to an alleged technical failure. .

The euro-dollar exchange rate is at its lowest level in the last 20 years. SOURCE: TradingEconomics

The fall of the euro against the dollar, to this minimum of two decades, comes on the first day of a week that will be marked by a summit meeting of the European Central Bank (ECB), pressured by inflation risks and, on the other hand, hand, that the energy crisis could push the largest economies into recession.

In contrast, in the US, the central bank (Federal Reserve) recently reiterated its promise that it will maintain its priority in fighting inflation, even with some signs that the US economy is also losing steam.

Powell acknowledges that there is “some pain” on the way to reducing inflation. But he says that he is determined to lower prices.

Source: Observadora