The Minister of the Economy and the Sea, António Costa e Silva, was careless and dared to suggest a transversal reduction of the IRC from 21% to 19%. Carmo, Trindade and the crusher of the Socialist Party fell on him. For those who make the distribution of benefits a way of life, a tax reduction can never be universal, because much more important than the tax reduction itself is the solemn announcement of those who want to be favored at all times with each measure.

For the government, all tax change announcements are ceremonial and always proclaim who is the group to which the perk is being offered. The IRS does not go down, but handouts are advertised for the youngest, through the young IRS. The Socialist Party is a friend of the youth. Taxes increase for everyone through inflation, since the IRS scales are not updated in successive years, but the cousin that the unfolding offers to hundreds of thousands of families. The Socialist Party is familiar. The news will be responsible for transmitting the message that 1.5 million Portuguese will benefit, ignoring the fact that almost all will be harmed.

Benefits are advertised to farmers with a courtesy in agricultural diesel, aid to transport companies, discounts on season tickets for those who travel by public transport. The Socialist Party is a friend of farmers, truck drivers and transport users.

We are constantly bombarded with announcements of new measures, but the one time a minister actually suggested a measure, it was immediately rejected. The Socialist Party has many friends, but only one group can enter the party at a time.

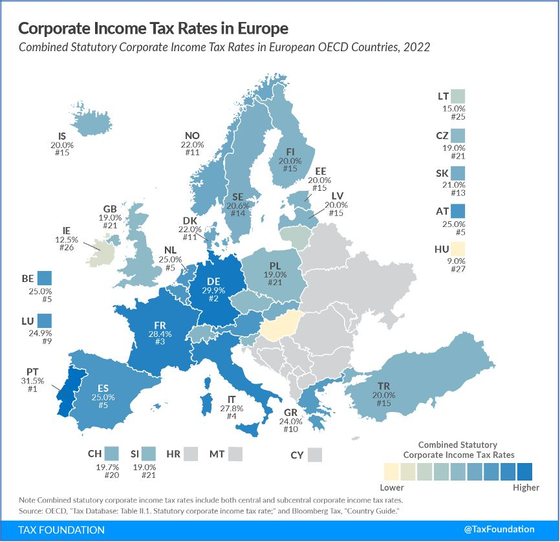

Let’s analyze what the minister suggested. the map that Tax Foundation published annually, shows that Portugal is already the European OECD country with the highest corporate tax rate, the rate that includes IRC, State Surcharges and Municipal Surcharges.

doctor

The change proposed by António Costa e Silva would see Portugal go from first to second place, being only slightly better than Germany, which is now second in this dismal championship. It was an update with minimal impact, but intended to signal to investors a change in fiscal policy. For suggesting that Portugal had the second highest income tax rate in Europe, the minister was vilified in the public square. for our tax lovers, Portugal cannot be second. It has to be the worst.

The maximum IRC rate does not apply to all companies in any country, as there are always tax benefits, incentives and deductions, exceptions and autonomous tax rates. In Portugal, state surcharges are staggered according to the level of benefits. And there are special taxes on banks or companies in the energy sector. That is, companies, on average, do not pay 31.5%. According to the Bank of Portugal, “EITHERThe microdata of Portuguese non-financial companies between 2010 and 2019 show that the ETR(Effective Tax Rate) average calculated considering in the denominator the EBT (earnings before taxes) has remained relatively stable around 25% in recent years”. Still, it is possibly the highest rate of corporate effort in the entire OECD.

In Portugal, the maximum rate applies only to companies whose profits exceed 35 million euros per year: large companies. Imagine the decision makers of any multinational choosing the country in which they want to invest in Europe, hoping to get a profitable business and make huge profits. They choose Portugal, where the company will be taxed at 31.5% on most of these results, or they choose Hungary where the rate is 9%, Ireland where it is 12.5%, Romania where it is 16%, Lithuania where it is 15%, or by Poland where it is 19%, like in the Czech Republic? Choosing the location for a large investment can be complex and time consuming, but eliminating Portugal from the options is easy and immediate.

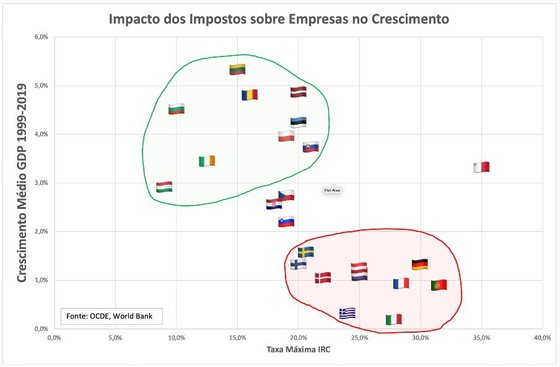

Has anyone in the government realized that these countries, given as an example, are among the richest in recent decades in all of Europe, while Portugal is paralyzed?

doctor

It is easy to understand that there are two clusters in Europe, which can be seen in the graph. That of the growing countries and the cluster of stagnation – with Portugal, between 1999 and 2019, the third country in the European Union that grew the least, defeating only Italy and Greece.

It should be noted that some countries that may not show low rates are small tax havens for special groups of companies. Traditionally, Luxembourg is home to investment funds, the Netherlands to corporate holding companies (SGPS, in Portugal), Ireland hosts large technology companies, Lithuania attracts fintech. Portugal is also a small tax haven for foreign retirees. And even Malta, which has a statutory IRC rate of 35% and is therefore listed as a isolated part in the graph it is also a tax haven, where most multinationals do not pay more than 5%. The world of corporate taxation is not a black and white world, but it is easy to see that the countries that some call tax havens are growing much faster than those that are obvious tax hells.

As if fiscal excesses weren’t enough, there’s a whole different bureaucracy that makes it much more efficient to invest in some countries and avoid others. And also there Portugal does not come out smiling in the photograph. The World Bank regularly publishes an indicator it calls “Time Required to Prepare and Pay Taxes,” an estimate of the number of business days an average business spends complying with state-imposed tax obligations. In the European Union, in 2019, only 3 countries with old bureaucracies inherited from communism fared worse than Portugal: Poland, Hungary and Bulgaria. In Portugal, the standard company dedicated 243 days to a worker to face the administrative burden imposed by the state in the field of taxes. In Estonia this value is 50 days, not in Luxembourg 55, in Ireland 82, in Lithuania 95. With the continual exceptions and rules that are being invented for all and for nothing in each government, this is one of two indicators that can be broken in the next years.

The fact that Portugal is a fiscal and bureaucratic nightmare for large companies does not mean that it does not receive foreign investment. Portugal may be attractive because the stagnation of recent decades means that wages are on track to become one of the lowest in the EU and the most skilled workers are put to good use by multinationals at low cost. To participate in the domestic market, foreign companies know that they are competing with other companies subject to the same regulatory framework, so they do not feel at a disadvantage.

Companies can come, but what rarely stays in Portugal are the benefits of these companies. The services provided by Portugal are sold out at prices close to cost. Transfer pricing, believed only by bureaucrats to be controllable, allocates profits where the amount to be paid for those profits is lowest. In such a way that the weight of the IRC in the GDP of Portugal is practically equal to that of Ireland, despite the fact that the rates charged are very different. In 2019, state income from corporate income represented 3.11% of GDP in Portugal and 3.05% in Ireland, with Ireland’s GDP per capita being two and a half times higher than Portugal’s.

Despite this disastrous situation, we live in a time in which excessive profits, unexpected profits, random profits, extraordinary profits, illegitimate profits are obliged to pay taxes, inventing a new adjective almost every day. There are many members of the government, of the Socialist Party and also of other parties of the left and right, who are embarking on this wave of the worst, the best. A sometimes funny situation is to see our tax lovers point to the example of low-tax countries when they advertise their extraordinary taxeswithout understanding that even after applying these special taxes, companies in these countries must pay much less taxes than their counterparts in Portugal.

A few years ago, Portugal saw how almost all the shares of the companies that were part of the main stock market index went to the Netherlands. The responsible attitude to this stampede would be to understand what the Netherlands is doing well and what we are doing wrong. In Portugal, the irresponsible attitude is always preferred: we blame the Netherlands for our sins. They are the bad guys, we are the good guys. We have a long way to go. Unfortunately, as the weak reactions to Minister Costa e Silva’s suggestion show, we are not yet ready to take even the first step.

Source: Observadora