Created in 1988, it came into force in 1989. Cavaco Silva was Prime Minister and Miguel Cadilhe was his Minister of Finance, and they signed the diploma that created the Collective Income Tax Code, even though profits had already been taxed since 1976. The IRC Code alone, since 1989, has undergone 1,350 changes. Committees were formed on three occasions to reform the IRC (2000, 2009 and 2014), but the evolution of this tax occurs almost every year, as part of the State Budget. A permanent tax reform, considers tax expert José Casalta Nabais, cited in the study for the Francisco Manuel dos Santos Foundation (FFMS), coordinated by Pedro Brinca (from Nova SBE) and who worked with Afonso Souto de Moura, Francisca Osório de Castro , João B. Duarte, Miguel Cortez Pimentel and Paulo Núncio.

The study aimed to evaluate whether the changes and rates applied had an impact on productivity and the creation of national wealth. Proposed to the FFMS in 2019, the study ended up surprising some of its authors in the elections. Pedro Brinca was a candidate for the Liberal Initiative in Coimbra (not elected), Miguel Cortez Pimentel collaborated (even before the elections) with the PSD in the proposal for the IRS, Paulo Núncio was elected deputy for the CDS and helped in the drafting of the AD. program.

Its authors guarantee that the study, however, does not have any political overtones and the FFMS recalls that the studies are evaluated by independent and international experts. Although the current Government has indicated in its program that it proposes:

- Reduce CRI rates, starting with a gradual reduction of 2 percentage points per year, until setting the rate at 15%, compared to the current 21%;

- Reduce autonomous taxes on company vehicles under the IRC by 20%;

- Promote the elimination, “gradually, of the progressivity of the state surcharge and the municipal surcharge in terms of CRI”.

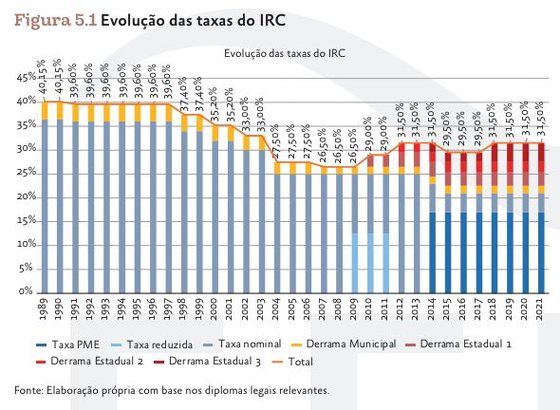

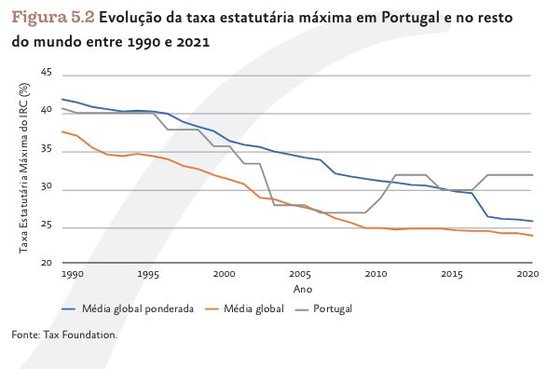

Companies, in addition to the IRC rate (maximum 21%), pay the state surcharge, created exceptionally in the 2009 crisis, in addition to the municipal surcharge, which can reach up to 1.5%. Therefore, the maximum aggregate rate depends on the geography of the registered office and the level of profit. The rate has varied over the years. Until 2010, “the downward trend observed internationally continued and, from that moment on, the Portuguese rate increased significantly,” reads the study to which the Observer had access.

FFMS Study

FFMS Study

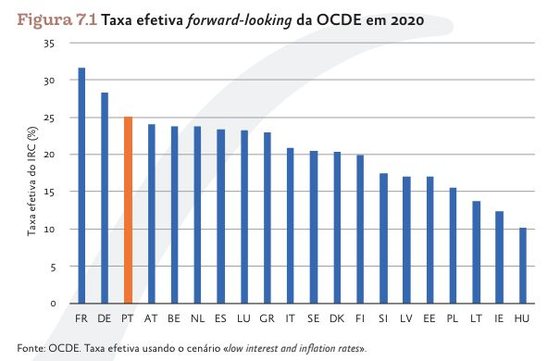

The study is based on the analysis of the CKD rate using the technique Looking forward — return on investment with and without CRI. According to this technique, which the OECD uses, Portugal, among 20 countries analyzed, has the third highest effective rate, behind Germany and France.

What happens if the rate falls 7.5 percentage points?

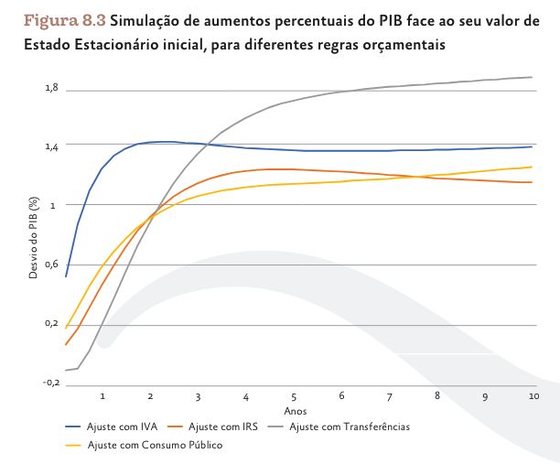

One simulation carried out in the study was a 7.5 percentage point reduction in the tax rate on profits paid by companies. According to the authors, this cut would mean an increase in GDP “in the short, medium and long term, increasing by 1.4% compared to its initial state prior to the IRC reform after 10 years.” According to the study, “the CIR distorts the decisions of economic agents, particularly those linked to investment, demand for workers and production.”

Therefore, when the rate falls, distortions decrease and GDP increases, driven mainly by the improvement in consumption, induced by the increase in labor income. According to the study, consumption is driven not only by the increase in the profits of those who own the companies, but also because the remuneration of work increases (1.79% after 10 years). “This increase in labor remuneration is the result of the increase in demand for workers by companies,” reads the study, which leads the FFMS to conclude that “the high IRC rates disproportionately affect workers.” .

GDP growth, on the other hand, is driven by increased public and private investment (to a lesser extent).

However, the trade balance would be negatively affected, as increased consumption tends to generate more imports, although exports would also become more competitive. But it wouldn’t be enough.

The study concludes, on the other hand, that tax revenues are decreasing. What happens, in fact, “in all the simulations presented in this study.” And contrary to what AD says, it could happen with the drop in IRC income. The AD considers that a reduction in CIT rates induces growth to the point of increasing income. Hugo Soares, parliamentary leader of the PSD, in the discussion of the Government program went so far as to say that in 2013/14, when there was a fall in the IRC, “what happened was that tax revenues increased, because we liberated our economy and companies produced more and I paid more taxes.” Now, this may have been induced by other factors, specifically because Portugal abandoned the adjustment program that year.

The authors of the study have no doubt about one thing: “the fall in the CRI rate must be compensated” so that the budget balance does not deteriorate. “The IRC reduction does not pay for itself“say its authors. Therefore, the study considers that for this not to happen, this cut must be offset by other measures, in particular an increase in consumption taxes, specifically 0.2 points after two years and 1 point after 10 years. “Thus, we conclude that the budget adjustment via consumption taxes, being less distorting taxes and not having, in the short term, as much impact on the disposable income of families as social transfers or public consumption, combines the most significant in the short term,” says the study.

Source study on the impact of the IRC

The study also simulates a drop of 7.5 points in the CRI, but with a reversal in the immediately following year (what is called the V reform). This would have long-term negative consequences for GDP, particularly consumption.

What happens if others lower rates?

The authors simulate, however, a drop in rates in the euro zone and the rest of the world (of the same 7.5 points) not accompanied by that in Portugal. The result is a decrease, in Portugal, in consumption and private investment. Even if the trade balance improved.

But “by following the decline of the CRI abroad, Portugal permanently has a higher GDP than it would have if it chose not to follow the trend abroad.”

What if the reform is at the higher levels?

The study also confirmed the decrease only at higher levels, that is, through the suppression of state discharges. And the conclusion is that GDP would be positively impacted, as would consumption and private investment. But given the transversal fall, the impact on GDP would be minor.

“Such a reform would represent the combination of a level reduction with a progressive reduction, both simulated separately in previous years. Since the higher levels have a significant weight in the total gains, the results of this exercise show that the structural gains (in this case, an increase in GDP of around 0.65% in the short term (after two years) , and about 0.2% in the long term (after ten years) – can only be achieved with changes in the rates for the upper tranches, that is, without the need to change the rates in all the tranches.

Although the Government program admits the gradual reduction of the tax, Joaquim Miranda Sarmento, Minister of Finance, has already admitted that there are no budgetary conditions for this reform to advance and even expressed doubts about the end of the progressivity of this tax.

Government insists on reducing the IRS in the first seven sections but Miranda Sarmento opened the door to other measures (except two)

Given all the simulations, the authors of the study affirm that what is recommended is “a general reduction in the IRC rate for all companies, as well as an elimination of state and municipal surcharges, accompanied by the necessary budget adjustment measures. These measures to reduce the IRC would allow, on the one hand, to reinforce the fiscal competitiveness of the Portuguese economy vis-à-vis the outside world and, at the same time, simplify the IRC, returning it to its matrix and proportional character.”

Source: Observadora