The IRS said it accidentally posted the confidential information of 120,000 people on a public website before finding the mistake.

Wall Street Magazine He reported that the IRS recently said it accidentally released sensitive information, including about 120,000 people, before discovering the error and removing the information from its website. The data is from Form 990-T, which is generally required for people with IRAs who receive certain types of business income related to these plans.

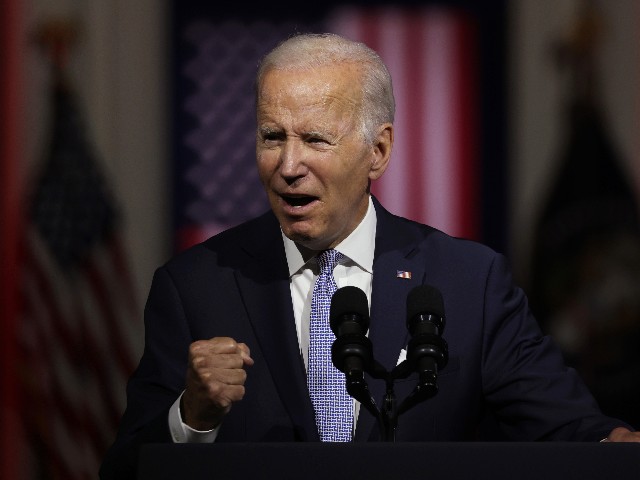

U.S. President Joe Biden delivers a first-class speech at Independence National Historic Park in Philadelphia, Pennsylvania, September 1, 2022. President Biden spoke of the “continuing battle for the soul of the nation.” (Photo: Alex Wong/Getty Images)

In this May 21, 2013 file photo, tea party activists demonstrate in Fountain Square before marching to the John Weld Peck Federal Building in Cincinnati to protest an IRS crackdown on conservative tax-exempt groups. (AP Photo/Al Berman, file)

Form 990-T users typically include people whose IRAs are invested in real estate or other income-generating assets of primary limited partnerships. Detailed information on Form 990-T usually includes names, contact information, and financial income information.

According to the Department of the Treasury, the form does not include social security numbers, complete individual income information, or other data that could affect a taxpayer’s credit. The administration will also reportedly send key members of Congress to discuss the leak on Friday.

The forms, like most individual IRS tax returns, must be kept confidential, but charities must also file Form 990-T and these documents must be made public. The IRS and Treasury attributed the issue to a human coding error that occurred last year when Form 990-T began filing electronically.

Non-public data is not intentionally integrated with public data and can be searched and downloaded on the agency’s website. wall street diary, The company, which regularly reviews nonprofit tax returns, uploaded some data before deleting it.

Anna Canfield Roth, the Treasury’s assistant secretary for administration, told lawmakers in a letter Friday: “The IRS continues to review this situation. The Treasury Department has directed the IRS to immediately review its practices to ensure that the necessary safeguards are in place to prevent unauthorized disclosure of data.”

Read more Wall Street Magazine here.

Source: Breitbart