From considering it “very unlikely” to raise interest rates before the end of 2022 (as Lagarde said at the end of last year) to assuming that interest rates will rise this summer, the Strong adjustment made by the ECB in recent months will have, this Thursday, a preclimax: the meeting of the Governing Council must confirm the end of purchases in debt markets that have been operating since 2015 and that were reinforced in the pandemic. However, despite the publication of “fresh” economic projections that should show increasingly worrying inflationary pressures, analysts are convinced that the ECB must remain faithful to the guidelines given to the markets in recent months and leaves the first interest rate hike for July – when she comes, however, it may be in a double dose.

The European Central Bank (ECB) has guaranteed for many months that interest rates will only increase after the debt purchase program is complete, which in recent years has been fundamental in keeping the financing costs of countries such as Portugal at historically low levels and, indirectly, in also compressing the interest paid by companies and families. Carsten Brzeski, chief economist at Dutch bank ING, says keeping this “sequencing(that is, first stop buying debt and then raise interest rates) is the “only argument” that justifies not announcing a first rate hike in June.

The question makes sense. “With inflation dynamics constantly surprising and continuing to rise, both headline inflation and the estimate excluding energy prices, the only question is why doesn’t the ECB raise interest rates anymoreat this Thursday’s meeting, underlines the expert. Moreover, taking into account that the financial markets have already adjusted to the new expectations transmitted by the heads of the ECB, it would be “easy to justify” not to wait any longer to make this decision that will be historic. But after having publicly guaranteed such a “sequencing”, analysts are convinced that the monetary authority will wait another month and a half -until July 21- to take a step that everyone knows will be taken soon.

“An interest rate hike as early as this week is an almost impossible scenario, but we cannot rule out one more surprise.” like those that emerged at several important ECB meetings in the first half of this year, says Carsten Brzeski.

Interest to go up. Monthly fee increase can reach 100 euros

The interest rate on deposits –at this time the main rate defined by the ECB– remains at negative value of -0.5%. And Christine Lagarde has already indicated that by the end of the third quarter she will no longer be in negative “ground,” meaning that between the June, July and September meetings there will be a total increase of (at least) 50 basis points.

Confirmed that interest rates do not change in June, the big question is what clues the ECB president can leave, already this Thursday, about whether the rise will really be “gradual”- 25 points in July and another 25 in September – or whether the strength of the “hawks” in the central bank will be enough to raise interest rates in July is therefore 50 basis points (which would send a much stronger signal to the markets).

At least five of the 25 members of the Governing Council (which brings together the board of directors and the governors of the different national central banks) have already publicly defended that the rise in interest rates should already be 50 basis points in July. Even the most cautious governors in the process of raising interest rates, such as Mário Centeno, changed their position when the inflation rate in the eurozone reached new records: 8.1% in May, after 7.4% in April. Not even Lagarde herself wanted to rule out that possibility, during a recent interview in Davos, Switzerland.

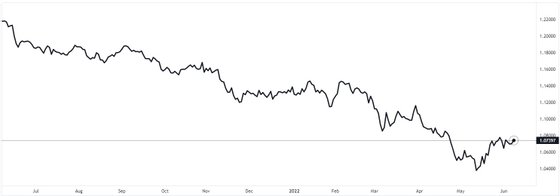

As well as pleasing ECB members most concerned about the danger of inflation, a one-time 50 basis point hike could help support the recovery of the price of the euro in the foreign exchange markets – something that the monetary authority would welcome at this time because the recent fall of the euro against the dollar was, in itself, an inflation-inducing factor, as it made oil and raw Materials energy, which are traded in dollars on international markets.

The price of the euro has recovered a bit in recent weeks, but has been under strong pressure against the dollar in the last 12 months. Source: TradingView

In a forward-looking note, BIS economists say they believe that “the most likely option at the moment is to do it with two official rate hikes of 25 basis points at the July and September meetings, but Some voices in the Governing Council are already demanding that the July rate be set at 50 basis points in order to leave the environment of negative rates as soon as possible.“.

Thus, “the press conference will be essential to see the level of agreement (or disagreement) on how and when to abandon negative interest rates, as well as the possible rate of increases in the medium and long term,” says BPI.

On the other hand, with the rapid increase in risk premiums on the debt of the countries of the so-called “periphery” of the euro zone, the BIS economists say that “we must also be attentive to any information on the possibility of a new instrument designed to alleviate possible financial tensions in the debt markets sovereign debt after the end of the purchases” in the debt market.

This increase in risk premiums (extends) debt –in simple terms, the difference between interest rates in Portugal and Germany, a “risk-free” reference in the euro zone– has already led the Portuguese State to have to pay an interest rate 2.33% for nine-year debt issued this Wednesday, more than double the cost incurred in a comparable issue made in February.

“The fact that we come out of negative interest rates is a process of economic normalization and healthy for the economy,” said Filipe Silva, director of investments at Banco Carregosa. However, “the current problem is that the pace at which everything is happening is much faster than initially anticipated”. And “the countries of the periphery have been more penalized in this movement, Portugal is not an exception and its spread against Germany continues to rise.”

Interest to go up. The new debt is no longer cheaper than the old

However, nothing concrete is expected to be announced to prevent interest rates from rising too quickly in countries, at least for now. Lagarde already emphasized, at the press conference on April 14, that the ECB “will guarantee that there is an adequate transmission of monetary policy” and that “unwanted fragmentation will be avoided”, that is, saying that, in some way, the ECB to ensure that there were not too large discrepancies in the financing costs of the different countries of the eurozone, as was the case until 2012/2013 (even when Mario Draghi promised to do “whatever it takes” to preserve the eurozone).

Holger Schmieding, an economist at Berenberg Bank, admits that “it is possible that the ECB will present a new instrument this Thursday so that there can be, for example, selective purchases of debt. [de alguns países em particular] In the future”. “Most likely, however, Lagarde will limit herself to stressing, even more emphatically than before, that the ECB will intervene in the event of such ‘excessive fragmentation’, without giving more concrete details.“, anticipates the specialist.

Source: Observadora