Those who went to a bank in recent years and asked for a mortgage loan (at a variable rate) were able to see a simulation of how much the installment would rise if the Euribor rates rose one or two percentage points or, in other cases, how much the Euribor would rise . pay if they returned to the highest level of the previous 20 years. These “dark days” of 2008 have not yet equaled, with rates above 5% – nor is this expected to happen soon – but after long years with the Euribor at low levels (even negative) the rapid increase in recent months is leaving calculating families in the lurch. Mainly because the house payment is far from being the only expense that is weighing more.

The reality is turning out to be even harsher than anticipated earlier this year, when credit ratings began to accelerate. Faced with inflation that threatens to become uncontrollable, the European Central Bank (ECB) has already made two “jumps” in the reference interest rates and has boosted the indices that govern the calculation of the installments paid by more than 90% of the families with mortgage loans – these are, in Portugal, the variable rate ones (those who take precautions with fixed rate loans are protected from these increases).

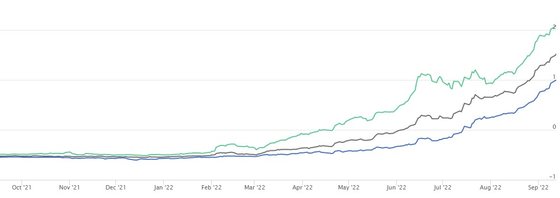

Anyone who has had regular monthly fee reviews is feeling the pinch. For example, in a loan indexed to the Euribor at 6 months, with 150 thousand euros financed over 30 years, with spread of 1%, the quota jumped from less than 450 euros in January to 495 euros if it was revised in July. But after that, the The Euribor has more than doubled in a few weeksso if these levels are maintained in the next review, the same loan will already have a fee of approximately 670 euros -that is, an increase of around 220 euros, within a year-.

Hot summer: Euribor rates have more than doubled in recent weeks. Green line: EURIBOR 12 months; Black line: EURIBOR 6 months; Blue line: EURIBOR 3 months. Source: Euribor-rates.eu

This article is exclusive to our subscribers: subscribe now and benefit from unlimited reading and other benefits. If you are already a subscriber, log in here. If you think this message is an error, please contact our customer service.

Source: Observadora