Do you have €100,000? Yes? Great! Do you need it? No? Even better. So in this case, if you invest it you will have a return that, let’s imagine, is 7%, which translates to €7,000. But as we live in a social state, you must give that same state to guarantee your well-being and ours, that is, security, health and education, the exact amount of 28%, that is, €1,960, which will allow you to maintain a net profit of €5,040. Do you consider that too much? Small? It depends on the materiality of each one.

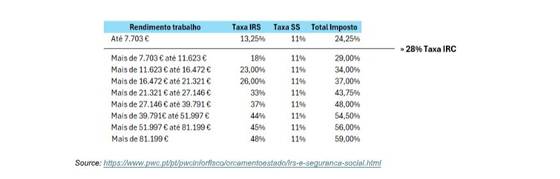

The truth is that if you work for a month and earn a gross monthly salary of 2,500 euros, a high value for the national market, but considered medium or even medium-low in other countries of the Union with more robust economies, you will get. See that on your receipt there is a discount rate of 37%. And don’t forget the 11% for social security! Out of a total of €35,000/year, €12,950 goes to the State and €3,850 to Social Security, which leaves us with €18,200… practically half. And it gets worse if we go up to the last step.

I ask: how will those previously called “brains” stay in Portugal? Or rent a house in Lisbon. Note that I did not write in the center of Lisbon, don’t worry, that is only for some people. Yes, some, because there are few apartments, the rest are local accommodations.

But the real question in this text boils down to this: should we not question the reasonableness of the tax? Those who have the means to earn capital income, will they not benefit from a 28% tax rate compared to a worker? Yes, because in order to achieve a tax rate for labor income equal to that for capital income, it is necessary to reach a midpoint between the first and second brackets of income tax and this has already improved with the new tables of the new State Budget for 2024. . Oh! And the time for the surcharge is over! Thank goodness!

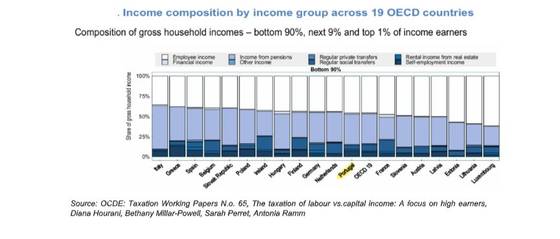

See the OECD chart below, where labour income (Employee income) and pension income (Pension income)represent the majority of household income up to 90% of all wealth, i.e. of the poorest households, in an income distribution. In Portugal this situation is no exception.

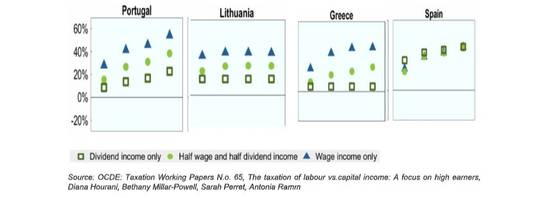

Even based on the same study, it is interesting to compare the Effective Tax Rate for different income levels, in this case, as a multiple (1, 3, 5, 20) of the value of an average salary.

As can be seen, the tax rate on labour income in Portugal is higher than the tax rate on capital, being mitigated when there is a combination of labour and capital income and, if possible, verifying the progressivity of the rates and levels reached compared to Lithuania, Greece or Spain. With Spain emerging as a positive example with greater balance for different types of income, even for different multiples of amounts earned or accrued.

It seems unfair and reinforces the idea that those who have more easily have more and those who have less have a longer road ahead. This idea is reinforced by the Study, particularly in terms of capital income, such as dividends and/or capital gains, which are generally subject to lower effective tax rates than income from work. In conclusion, no one gets rich by working, it is better to invest.

Source: Observadora