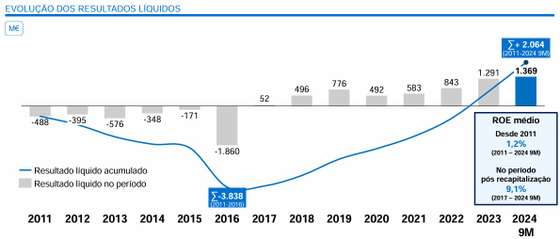

Caixa Geral de Depósitos closed the first nine months of the year with a profit 39% higher than the same period of the previous year. The public bank obtained results of 1,369 million of euros, a record, indicated Paulo Macedo in a press conference held in Lisbon to present the results that were also disclosed through the Securities Market Commission (CMVM). In this press conference, Paulo Macedo, whose term ends at the end of the year, He confirmed that he was invited by the Government to continue in the public bank and his intention is to continue.

As usual, the public bank presents an account of the amounts delivered to the State coffers, including taxes and dividends (because the State is the only shareholder of the bank): in these nine months there were 1,527 million eurosaccording to the bank. “Caixa pays the State, in 2024, 4.5 million daily in dividends and IRC, referring to 2023 and 2024, for an annual total of 825 million and 840 millionrespectively,” states the public bank.

“Deliveries to the State planned for 2025Taking into account the results already obtained, will have an equally relevant magnitude“says the bank, which is expected to make record profits in 2024, before these may fall slightly in 2025 due to the effect of the foreseeable fall in interest rates.

For now, even though interest rates are already falling, the financial margin has still increased, albeit slightly. This crucial element for banks’ results increased 1.5% to 2,121 million euros (1.9% in national operations).

It is, in simple terms, the difference between what the bank charges for the loans it grants and its financing costs (customer deposits, broadly speaking). The stabilization of the financial margin will be related to the fact that the drop in interest rates is slowly reflected in the calculations of the installments paid by clients, which are reviewed only within defined periods (general rule, three, six or 12 months). ). The peak of Caixa’s financial margin occurred in October 2023, indicated Paulo Macedo, and since then it has been falling.

The bank also charged plus 2.6% in commissions, for revenues of 437 million of euros. Caixa guarantees that it has not changed prices and that the higher commissions are due to “greater transactionality” on the part of customers.

Profits in the first nine months higher than those of the entire year 2023. SOURCE: Caixa Geral de Depósitos

With these profits, Caixa obtained a return on its own capital (return on capitalor ROE) of 18.8%.

Paulo Macedo, whose term ends at the end of the year, confirmed in the press conference that he was invited by the Government to continue in the public bank and that it is his intention to continue leading the executive committee.

Source: Observadora