The State went from a surplus of 1,177 million euros to a deficit of 259 million euros in the first quarter of this year. A deficit situation that, according to the General Directorate of Budgets, has not occurred since December 2022.

Given this situation, the Ministry of Finance sent a statement attacking the previous Government.

“This strong degradation of the budget balance, between January and March 2024, is due, to a large extent, to decisions and commitments made this year by the previous government and, in many cases, after the elections of March 10,” it states. read in the statement. The Observer is waiting for answers from the Ministry of Finance about what these measures were.

In that same statement, the Government indicates that, on the other hand, “the central administration’s debts with suppliers increased by around 300 million euros in the first three months of the year.”

The current Executive of Luís Montenegro took office on April 2.

Thus, in the first three months of the year, the budget balance decreased, in public accounting, by 5,317.5 million euros compared to the same period of the previous year, which generated a quarterly deficit. Even so, taking into account that, in 2023, there was a transfer of responsibility for the pension fund from Caixa Geral de Depósitos, which ends up having an impact on the year-on-year comparison. Even excluding this effect, the balance would have decreased by 2,299 million euros. And that, according to the General Directorate of Budgets, “resulted from the combined effects of the decrease in income (7.4%) and the increase in expenses (15.1%).”

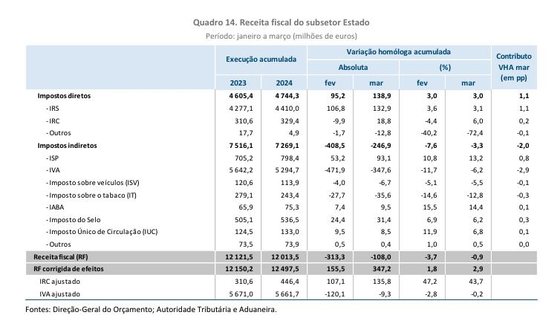

Income grew by 4.3%, without the operation of the pension fund, and tax income fell by 0.3%.

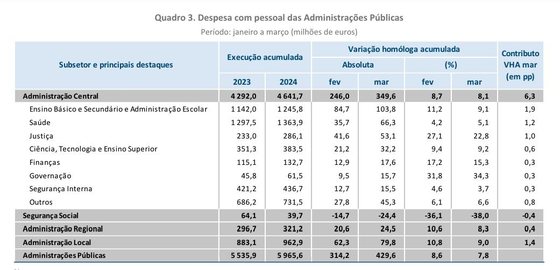

In terms of spending, primary spending grew by 15.7% due to increases in transfers (23%), personnel expenses (7.8%), and the acquisition of goods and services (7.2%). The DGO indicates that transfers increased due to pension charges, which had their value updated this year and the increase in pensioners. But also due to “measures to mitigate the impacts of the geopolitical shock and inflation, with emphasis on compensations related to the containment of electricity rate prices.”

According to the DGO, as part of the mitigation of the geopolitical shock, in March there was a drop in income of 249.8 million euros and an increase in expenses of 673.9 million euros. The loss of tax revenue was due to the reduction in ISP equivalent to the reduction of VAT to 13% (177.4 million euros), as well as the return of additional VAT revenue through ISP (66.9 million euros). euros). On the expenditure side, there were payments related to the allocation of funds to the National Electric System (SEN) to reduce rates, amounting to 566 million euros and, to a lesser extent, the impacts of extraordinary income support (80, 7 million euros). ) and the exceptional pension supplement (23.7 million euros)

What will the Government do with the mega fuel tax discount that it inherited from the PS?

Pensions were updated in January, a month in which the State continued to have a budget surplus. Also in February there was a surplus. Only in March did the deficit disappear.

The State closes January with a budget surplus close to 1,200 million euros, less than a year ago

Personnel expenses increased almost 8%, partly due to salary increases and career adjustments. The increase was greatest in justice with an increase in the cost of this item of 22.8%, but also in governance (34.3%) and finance (15.3%). In education, growth was 9.1% in personnel spending and in health, 5.1%.

The DGO indicates that “the values presented are influenced by the process of suppression of the Immigration and Border Service, with a decreasing impact on the Internal Security Program and a growing impact on the Justice and Governance Programs.”

Source: DGO

Regarding tax revenues, which fell by 0.9%, the DGO explains how they were influenced by “the effects of payments related to the IRC deferred tax assets (117 million euros) in February 2024 and the extension of the VAT payment (28.7 million euros in March 2023 and 367 million euros in March 2024). Excluding these effects, tax revenues would have grown by 2.9%, as a consequence of the evolution of the IRC (43.7%, +135.8 million euros), the IRS (3.1%, +132.9 million euros) and the ISP (13.2%, +93.1 million euros).

Source: DGO

Source: Observadora