Will physical money, as we know it, ever disappear? Judging by the number of times we unsuccessfully search for coins to pay for parking, it almost leads us to say yes. But it is very likely that the answer will not be so immediate, especially since there are always segments of the population that do not have easy access to innovation, as Juan José Llorente, Country Manager of Adyen for Portugal and Spain, comments in an interview.

What has come to stay, indisputably, in his words, is the “phygital” -term that results from the union of the words physical and digital- that represents the purchase journey of many consumers around the world and that is nothing more than the fusion of all the possibilities of acquiring goods or services that are, today, at our disposal. For example, it is the possibility of opting for e-commerce after seeing a sofa in person (or choosing to do the exact opposite), or, being in the store, following the QR Code to obtain more information about the smart watch that we have in store. hand at that time. ; it is to return a piece of clothing bought via mobile phone to the store or to receive at home a beautiful desk bought during a vacation abroad.

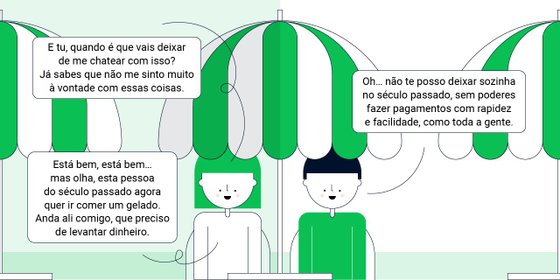

Illustration: Joana Figueroa

All this is also possible thanks to the multiple forms of payment that consumers currently have at their disposal – from Multibanco to contactless cards, through digital wallets such as MBWay, Apple Pay, Google Pay, among others – and whose operation is guaranteed with complete security. by payment platforms such as Adyen.

The momentum of the pandemic

We have no idea how long it would have taken to get to the current point, in terms of the implementation of online commerce and the use of digital means of payment, if the Covid-19 pandemic had not occurred. In fact, the boost recorded was gigantic and, in Portugal alone, the value of e-commerce will have reached close to 8 billion euros in 2020, according to data from the Digital Economy Association. According to the SIBS, in the two years of the pandemic, purchases made through contactless cards registered exponential growth, with operations carried out growing 387% in number and 685% in value, compared to pre-pandemic indicators.

These numbers are confirmed by the recent “Adyen Report on Retail 2021 – The metamorphosis of retail”, according to which, since the pandemic, 44% of the Portuguese preferred to pay by card or digital wallets instead of cash. Juan José Llorente acknowledges that “it was the issue of health that drove him”, but he has no doubt that “the use of digital cards and wallets will continue to be important in the future, and should continue to grow little by little”.

In the same report, we learned, unsurprisingly, that it is among the younger population that digital is thriving, with 86% of respondents aged 18-39 assuming they prefer to use cards, while 27% of respondents in this age group Do not even use physical cards, but opt for mobile devices and/or digital wallets. Still, the Adyen manager does not believe in the total substitution of physical money.

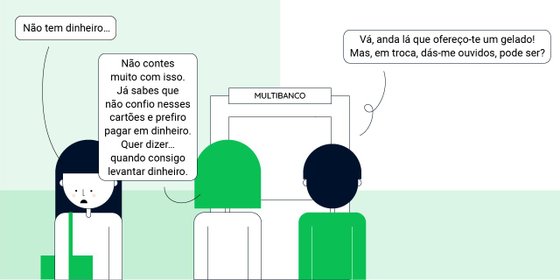

Illustration: Joana Figueroa

“We saw a very important reduction in two payments made with physical money, but this did not disappear”, he sublined, adding that “this is also an issue related to economic inclusion, since not all people, of all age groups, have a bank account”. As an example, remember that “minor have limited access to credit cards, in addition to the fact that a part of the older population finds it difficult to make changes and start using cards”.

Do what the consumer wants

Taking into account the diversity of means and methods of payment available, as well as the rapid evolution that has occurred towards digital, it is important to know what the real needs of Portuguese consumers are when making a purchase. The majority of respondents (64%) assume that they want to be able to choose between several methods – in fact, 26% reveal that they have already left a place without buying what they wanted because their preferred payment method does not exist – and the good news It is that retailers are aligned with this will.

In fact, 75% consider it very or quite important for their business to ensure that they offer all the payment options that their customers want to use. Juan José Llorente sees this figure as “a very positive figure”, because “it is the recognition that payments, both those made in physical stores and also, and even more so, online, have a very direct impact on sales” . In his words, the expansion of payment methods is seen by retailers as “a very simple way to access new market niches and increase conversion”.

Yet despite this recognition, only 36% of marketers have a formal and active digital strategy. For the Country Manager of Adyen, this is not a cause for concern or synonymous with any type of blockade, since “during a pandemic the need for adaptation became evident”. Therefore, he believes that “it is likely that, when this Retail Report is done again, that figure will have increased a lot, because retailers are more aware and will have had time to structure themselves in a more organized way. [a estratégia de pagamentos digitais]”.

“Phigital” friend from Portugal

As digital strategies are implemented, the consumer has more possibilities to carry out hybrid or “phygital” shopping experiences. That is to say, in which they have the freedom to decide the context in which each step of the operation will be carried out, for example, going to the store to see the product in person (60% of the Portuguese still prefer stores physical), buying it online, receiving it later at home on a specific date, in addition to having the possibility of making changes or returns in a physical store, if you wish.

Juan José Llorente calls this trend, which we will continue to hear about in the coming years, “unified trade” and admits that “Portugal has a very interesting position in this field”, first of all because “it has access to the same suppliers of technological payment and logistics services than the large European countries, but it is a slightly smaller market and where we see that some international companies like to innovate”. This attraction for our country is due, in his words, to the fact that Portugal is “a country relatively open to innovation, where there is a lot of technological development, that people look for quality of life and where tourism is also important” . , being that tourism is open to digital means of payment and to some of these new concepts such as ‘phygital’”.

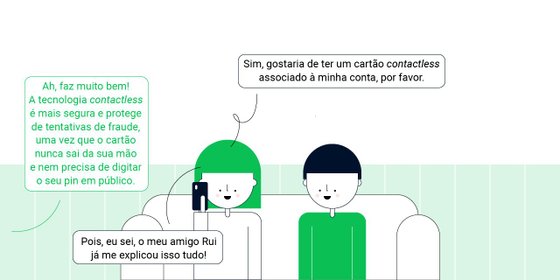

Illustration: Joana Figueroa

On the other hand, the Portuguese themselves are excellent candidates to adopt this hybrid concept. Proof of this is that 36% of those surveyed say that the convenience of shopping (where the store is, shipping and return options, etc.) is more important to them than the price of the items, which reinforces relevance experience for domestic consumers.

What is left to do?

Regarding security, which is usually a relevant issue when it comes to digital payments or through cards, the official recalls that actions such as the Payment Services Directive 2, the European directive that regulates payment services, came to fill some loopholes in consumer protection. “There was an impact. [na adaptação], but we are seeing that online fraud has decreased”. Even so, he argues that the security of transactions “remains an element that we cannot forget”, even drawing the attention of companies to the systems they use, in order to guarantee the security of their databases.

Asked if Portugal is ready or not for the digital transformation, the official considers that “the Portuguese are ready, some companies are too and others should be and are not”. Even so, he is “positive”, assuring that “today is not too late” for those who have not yet jumped on the digitization train. “As soon as they can, they have to do it,” he warned, reinforcing that “technology providers are here to increasingly facilitate the digitization of companies.” “There’s quite a learning curve, so it’s important to do it as soon as possible,” he concluded.

Source: Observadora