Key moments

-

Lagarde refuses to say it was the last interest rate hike -

A “solid majority” of governors agreed to raise interest rates, “some” wanted a break -

Inflation will be above 3% even in 2024. Growth will be lower than expected -

The central bank notes that this will have been the last increase, but interest rates will remain at these levels for a long time. -

The ECB confirms the increase in interest rates, the tenth consecutive. The rate rises to 4%, the highest level ever recorded -

“Stubborn” inflation makes an interest rate hike this Thursday more likely

Live updates

1 in

1

-

The ECB wants to protect the people who suffer the most from inflation

Christine Lagarde guarantees that the ECB’s objective is not to cause a recession (thus contributing to a reduction in prices). What the president of the ECB chooses as a priority is to “guarantee price stability” to protect “those who suffer the most from inflation.”

This is a justification that the Frenchwoman has already given in the past to explain why the ECB raised interest rates so many times in a row: this could penalize those who have credit and those who need new credit, but the alternative is to let inflation continue. rising and punishing more those who have fewer resources.

-

Lagarde refuses to say it was the last interest rate hike

Questioned by a journalist, Christine Lagarde refuses to say, in black and white, that this was the last increase in interest rates. “We cannot say that we have already reached the top.”, guarantees the president of the ECB.

The most important phrase that was included in the statement – which indicates that interest rates have already reached levels that, if maintained here for some time, will contribute to controlling inflation – has a fundamental element: this is an analysis that can be carried out cape. was “based on the evaluation current what the ECB is doing” of economic conditions.

In other words, it is implied that if the ECB’s assessment of the economy changes in the future, then the monetary authority will be able to make other decisions.

-

A “solid majority” of governors agreed to raise interest rates, “some” wanted a break

The decision to raise interest rates by 25 basis points was not unanimous and ended up being the option of the monetary authority. There was a “solid majority” of the members of the Governing Council who considered this to be the best option, but there were “some” who preferred that the central bank take a “pause.”

This was the tenor of this morning’s debate, according to Christine Lagarde, after Council members spent long hours on Wednesday analyzing the available economic data, especially that prepared by ECB economists, in the new quarterly macroeconomic projections.

“Evidently some deputies do not reach the same conclusion,” when observing the available data, “some governors would have preferred to pause and reserve more decisions for when there is greater certainty and more time has passed on the decisions already taken in the past.”

“It is not the ECB’s custom to say who did what and when,” but “it was a solid majority,” said Christine Lagarde, guaranteeing that there were different opinions but “it was not an antagonistic discussion”…

-

-

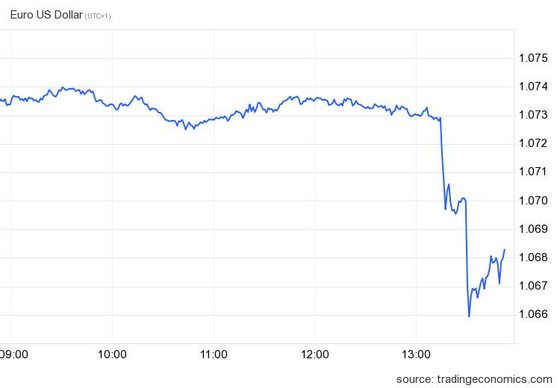

The euro loses ground against the dollar in currency markets

When Christine Lagarde begins to speak at the usual press conference, the euro is losing value in the currency markets, especially against the dollar.

The 0.5% drop in the euro-dollar, to $1.0672, is a reaction to the signal given by the ECB that this should have been the last interest rate rise in this cycle. On the other hand, data on retail sales and inflation in the US were released, which could also be contributing to the appreciation of the dollar (and consequent devaluation of the euro).

-

Inflation will be above 3% even in 2024. Growth will be lower than expected

The year 2023 is expected to end with an average inflation rate of 5.6% in the euro area and even next year a less pronounced fall than previously estimated is expected. The ECB’s new macroeconomic projections point to an average inflation rate of 3.2% in 2024, with a decrease to 2.1% in 2025.

On the other hand, the news is not encouraging in terms of growth either. Compared to the ECB’s previous projections, the ECB’s expectations staff of economists it became a growth of only 0.7% in 2023, 1% in 2024 and 1.5% in 2025; These are downward revisions, for all years.

-

The central bank notes that this will have been the last increase, but interest rates will remain at these levels for a long time.

In the statement accompanying the decision to raise interest rates, the ECB gives what can be read as a signal that this will have been the last interest rate rise in this cycle.

“Based on the assessment currently carried out, the ECB considers that Interest rates reached levels that, if maintained for a sufficient period of time,will contribute significantly to ensuring that inflation returns to target in a timely manner,” says the ECB.

Going forward, the ECB says it will “base its interest rate decisions on the assessment of the inflation outlook, in light of emerging economic and financial data.”

-

The ECB confirms the increase in interest rates, the tenth consecutive. The rate rises to 4%, the highest level ever recorded

The ECB even decided to proceed with another interest rate increase, of 25 basis points, which raises the deposit rate – the most important for monetary policy at the moment – to 4%, the highest level in the history of the ECB. euro. zone.

The decision to raise interest rates is justified by the need to “reinforce” the progress already made in reducing inflation.

-

“Today there should be a new rise in interest rates”

Filipe García, economist at Financial Markets Information, explains that this “should be the last rise of this cycle.”

Listen to this morning’s “Prepared Response” here.

“Today there should be a new rise in interest rates”

-

“Stubborn” inflation makes an interest rate hike this Thursday more likely

At the same time as the interest rate decision will be announced, the ECB will publish a set of updated macroeconomic projections that should estimate average inflation above 3% not only this year but also in 2024.

If this is confirmed to be the ECB’s projection, it would mean that the central bank’s economists recognize that inflation will fall more slowly than expected, reinforcing the idea that Christine Lagarde could announce a new interest rate rise, the tenth consecutive. .

Read here the advance text published by the Observer on Wednesday.

ECB. “Stubborn” inflation makes an interest rate hike this Thursday more likely

-

Good afternoon.

Let’s follow this article. live blog the decision of the European Central Bank (ECB) on interest rates, which will be announced at 1:15 p.m. (Lisbon time).

Christine Lagarde’s press conference begins half an hour later, at 1:45 p.m.

Follow all decisions here.

1 in

1

Source: Observadora