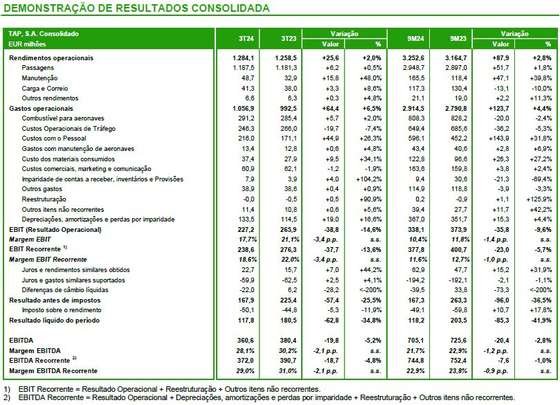

TAP obtained a profit of 118.2 million euros in the first nine months of the year, a figure that represents a drop of 41.9% compared to the same period last year. The third quarter contributed 117.8 million euros to this result, and the results continue to improve quarter after quarter. Until June, profits stood at 400,000 euros. The second quarter had been the first with profits since wage cuts stopped.

TAP makes profits in the first quarter without salary cuts, but points to “some pressure” for the second half

Profits continued in the third quarter. They reached 117.8 million euros, which represents a year-on-year decrease of 62.8 million due to the impact of exchange rate losses. TAP chooses, however, to also compare with the third quarter of 2019, before the pandemic, highlighting an improvement of 116.6 million.

Until September, in the first nine months of the year, operating income reached 3,252.6 million, 2.8% more compared to the same period last year and 30.6% more compared to the first nine months of 2019 . load factorwhich indicates the occupancy rate of aircraft, improved one percentage point, but TAP also highlights the growth in maintenance income. Ticket revenue was up 1.8% in nine months, while maintenance revenue was up almost 40%.

Recurring operating costs increased more than operating income. They increased by 4.0%, reaching 2,874.9 million euros. Personnel costs, which compared to a year (2023) still of cuts, increased by 31.8% in the first nine months and in the quarter registered an increase of 44%.

The company explains that the variation is due “mainly to the increase in personnel costs due to new company agreements that only came into effect in the fourth quarter of 2023, except for the agreement with pilots that came into force in the third quarter of 2023. , and the increase in depreciation and amortization (+19.0 million euros or 16.6%).” The increases “were partially offset by the decrease in traffic operating costs (-19.7 million euros or 7.4%) due to the reduction in ACMI contracting (aircraft rental) and the reduction in costs with irregularities.”

Thus, if the revenue per passenger per seat kilometer (PRASK) decreases by 0.04 cents, remaining at 7.29 cents, the cost per passenger per seat kilometer offered increases to 7.11 cents, including the cost of fuel.

Thus, recurring EBITDA decreased by 1% to 744.8 million in the first nine months.

Quoted in a statement, Luís Rodrigues highlights the two great challenges of the third quarter: “the difficult situation of the management of European airspace and the significant devaluations of currencies.” But he states that “the improvement in punctuality and NPS (Customer Satisfaction Index) and the stabilization of regularity confirm a more robust operation with better service for our clients, which translates into increased income and consolidation of operational results”. TAP adds that for the fourth quarter of 2024 “bookings are slightly higher than the previous year and are expected to offset some pressure on returns” (profit per passenger kilometer). In November, the company completed the issuance of bonds worth 400 million euros, at a rate of 5.125%, provided for in the restructuring plan. In the fourth quarter, TAP highlights that it will continue investments in Brazil with the opening of a new route to Manaus and will receive two new A320 Neo aircraft, replacing two A320 CEO.

Source: Observadora