The price index for energy products registered a jump of 27.3% in May compared to the same month last year, which is the highest value since February 1985, the National Institute of Statistics (INE) highlights on Tuesday. definitive on the evolution of inflation.

The INE confirmed that inflation reached 8% in May, a rate 0.8 percentage points higher than that registered in the previous month and the highest since February 1993. to unprocessed food products, which rose by 11.6% (9 .4% in April).

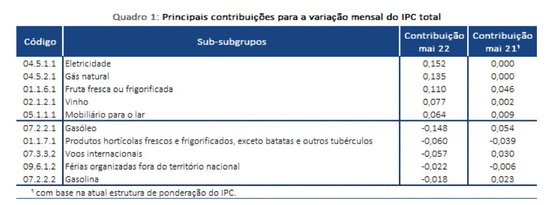

Despite the fact that the increase in fuel prices made headlines in recent weeks, the main factors responsible for the acceleration in prices in May compared to April were electricity and natural gas, with contributions of 15.2% and 13.5%, respectively. Diesel and gasoline, for their part, contributed negatively to the rise in prices in May, a behavior that the INE attributes to the “impact of the reduction in the ISP rate (tax on petroleum products) verified at the beginning of May”. The effect of the Government’s decision to lower taxes has already been absorbed by the increases in the last week of May.

In the case of electricity and natural gas, the month of May already reflects the increases in regulated rates, but also the updating of prices by marketers in the liberalized market such as EDP. Electricity prices should begin to fall in July, also as a result of the entry into force of the Iberian mechanism to curb the prices of gas used to produce electricity.

Inflation accelerated in May, increasing 1% compared to April, with prices of products such as fruit and wine still under pressure.

The INE data also show that the rise in prices is already a widespread phenomenon throughout the economy, with the underlying inflation indicator (CPI excluding unprocessed food and energy) reaching “an interannual variation of 5.6%, rate 0.6 percentage points higher than that recorded in April 2022. This is the highest value recorded since October 1994.”

The INE also highlights in relation to this indicator that Portugal “reached an interannual rate of 5.8% in May (5.3% the previous month), a rate higher than that corresponding to the Eurozone, which stood at 4.4 %”. , and adds that “Portugal has shown a very pronounced upward profile in recent months, standing above the eurozone average since January 2022. In May, this difference remained at 1.4 percentage points (identical value in April )”.

Source: Observadora