The Resolution Fund received 258.7 million euros in contributions from banks (extraordinary and regular) in 2023, which allowed it to increase its own resources, but not enough to liquidate the balance, which remains in a very negative situation due to to Banco Espírito. Holy. The “hole” in the Resolution Fund remained, at the end of 2023, at 6,735.1 million euros, due to the debt of 7,511.9 million euros, of which 85% was debt with the State and the rest with the banks.

“No debt amortization of the Resolution Fund was carried out, as the applicable interest rate remained at zero until the dates of the next refixation,” explains the entity in the 2023 report and accounts, although it indicates that, as its equity increased to 883.3 million euros, of which 709.3 million euros are cash or accounts receivable, “the Resolution Fund has treasury capacity to face possible contingencies that may still materialize and/or to begin to pay their debt before the next revaluation of the respective interest rates.”

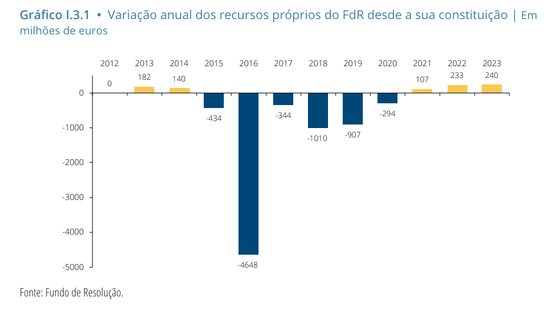

In addition to the resources from bank contributions, the Resolution Fund guaranteed, in 2023, capital gains from dividends from Oitante for a total amount of 57.1 million euros (after taxes). This contributed, in addition to a positive net result of 7.7 million, to improving the strongly negative situation from one year to the next, which in fact, as the Resolution Fund highlights, is occurring for the third consecutive year. The improvement was 240 million, going from a negative situation of 6,974 million to 6,735 million.

Source: Resolution Fund

Resolution Fund fails in six Novo Banco operations

The Resolution Fund did not have to pay, neither in 2022 nor in 2033, any amount owed by the Contingent Capitalization Mechanism, created when Novo Banco was sold to Lone Star. “Despite the lack of payment requests, the year 2023 “It continues to be demanding and continues to demand the rigor and care that the teams that ensure the functioning of the Resolution Fund have always put into the monitoring contracts.”

The Resolution Fund had to comment on 46 operations, six having failed (13%). In another 32 (70%) it communicated recommendations or conditions for its implementation to Novo Banco. “In only 8 (17%) of the operations on which the Resolution Fund issued its opinion in 2023, the action recommended by Novo Banco was not opposed by the Resolution Fund, in the terms it proposed.”

The Resolution Fund records, over the years and until the end of February of this year, a total of 386 operations presented by Novo Banco, with 13% failing.

Although this year the arbitration tribunal ruled in favor of Novo Banco in a payment that had been rejected by the Resolution Fund, this entity recalls in its report and accounts that this year the Supreme Court of Justice confirmed the appeal ruling in favor of the Resolution Fund for one of the disputes (implementation of IFRS 9) that “represented a saving of its resources in the amount of 169 million euros.”

And with this, the Resolution Fund highlights that, “considering the amounts claimed or anticipated by Novo Banco under the Contingent Capitalization Agreement, in aggregate terms, the maximum limit of 3,890 million provided for in the agreement would have been reached.” Had it not been for the timely intervention of the Resolution Fund and its opposition to the attribution to the contingent capitalization mechanism of certain losses and costs that Novo Banco has considered worthy of coverage by said mechanism.” The value of the payments made by the Resolution Fund amounts to 3,405 million euros, “which corresponds to 956 million euros less than the aggregate value of the accumulated losses for the assets covered by the contingent capitalization mechanism, that is, about 78% of the value of these losses”.

Therefore, the amounts actually paid are lower than the maximum limit in 485 million euros“due to the actions and intervention of the Resolution Fund.”

In addition, the Resolution Fund must still receive 128 million euros from Novo Banco due to the receipt obtained from one of the debtors, not specified, which means that the overall net balance is 3,277 million, 613 million less than the limit of the agreement . “The Fund and Novo Banco entered into an agreement under which the Fund is granted the right to benefit from amounts that Novo Banco may eventually recover in relation to its exposure to a particular obligor, in an amount that exceeds the book value . net of impairments, which was recorded on the reference date provided for in said agreement”, which occurred.

Source: Resolution Fund

Source: Observadora