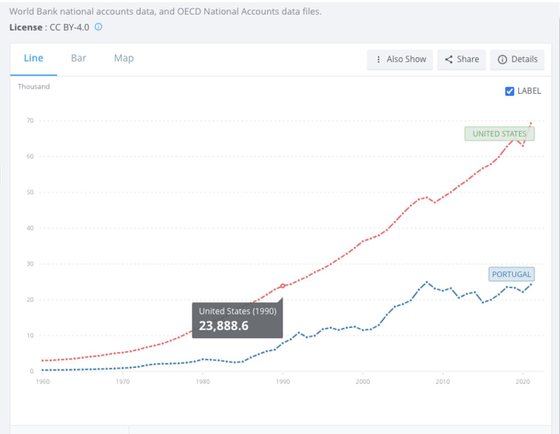

At a recent conference, an economics professor trained in stanford who was a teacher at London Business School, London School of Economicsuniversities of berkeley Y Yaleand is currently a professor of economics at New York University Leonard N. Stern School of Business, commented on the opportunities and challenges of the Portuguese economy, identifying the Portuguese economic growth as the main problem. He presented a graph comparing Portuguese and North American GDP per capita (GDP pc) similar to this one:

dr.

The lack of growth of the Portuguese economy, in the opinion of the professor of economics of the new york universityit currently translated into a lag of about 30 years relative to the US, making it impossible to present a single reason for this lack of growth, as it was due to multiple factors.

The former teacher of London Business School it also focused, among other aspects, on the different generations of Portuguese since the third decade of the 20th century. XX, naming the 1935-55 generation abroad1955-80 freedom generation (which saw in the incorporation to the EEC, today the European Union, the solution to all its problems), the 1980-2000 as the euro generation and the one from 2000 to today as our Z generelationship. He considered that the greatest difference between these generations resided in the transition to euro generationwhich registered the greatest explosion of human capital, with four times as many university students, an extraordinary increase in scientific research, doctorates and university courses.

According to the former professor of London School of Economics, the 30-year delay with the US, while real, was not so bad; it just meant that we were living in the Reagan era of the American economy, so the picture was not entirely negative.

Speaking of the next 50 years, the former professor at the University of California, Berkeley hinted at a “quite bright” future for Portugal, a country favored by the service economy and the digital world, predicting that it could become a California or a Florida of Europe – a recurring idea among economic analysts since the 1980s – with a high concentration of human capital, an excellent climate, a good tax regime, a time zone that allowed for simultaneous listing on the North American, European and Asian stock markets, offering quality health services and where the demand for assisted living could play a significant role.

Looking at the graph, one actually sees a growing discrepancy between the two lines: in 1980 we were, in terms of GDP pc, 17 years behind the US, which we managed to reduce in 1990 to 15 years, but in 2000 the lag already increased to 21 years. The greater discrepancy has been verified since 2008 because Portugal, in reality, still has not recovered from the financial crisis, being its GDP pc in 2021 still lower than that of 2008. On the other hand, the USA will rise surprisingly in its GDP pc by about 30% this period. Therefore, the 30-year lag that we currently have in relation to the US has a clear tendency to increase.

Regarding the generational divisions proposed by the former professor of economics at the University of Yalepoints out that the substitution of generation abroad For him European Union Generation/freedom generation led to an increase in the discrepancy between the Portuguese and US GDP, and that this discrepancy increased significantly with the entry into the Euro Zone that marked the euro generation. For a brief period of six years we were on a path of convergence with the United States. However, from 2008 to 2021, the Portuguese GDP fell by 2.75%, while the North American increased by around 30%. In 2022, to maintain the gap we had with the US in 2008, we needed to have grown significantly twice as much as we actually did.

The inability to recover from the financial crisis, despite the help of the European Union, deals a serious blow to our hopes of convergence with the most advanced economies and shows that, although the euro generation has benefited from an extraordinary explosion of human capital and exceptional community funds, it has not been able to translate this huge investment into economic convergence.

On the other hand, most of the conditions mentioned for the aforementioned “bright” future have already existed for decades: the euro generation it began in 1980 and ended in 2000 – and did not prevent the discrepancy between the evolution of Portuguese and North American pc GDP from widening. On the contrary: as we have seen, the discrepancy increased, especially from 2008. Indeed, the Portuguese GDP pc not only stagnated from 2008, but even fell by more than 20% until 2015 and since then, until 2021, it has not it has been able to exceed the value of 2008. However, the US rose, as we have seen, around 30%.

With this stagnation, it is not surprising that the forecast is that we will soon be overtaken by the Romanian economy, after having already been overtaken by Slovenia, Malta, the Czech Republic, Slovakia, Lithuania, Estonia, Poland and Hungary.

In this sad situation, how is it possible that the first London Business School, London School of Economics and universities of berkeley Y Yale Could you think that Portugal has a “bright” future, when the available information points in precisely the opposite direction? There is an inexorable and progressive discrepancy in our GDP pc in relation to the most advanced countries, despite community aid and the aforementioned explosion of human capital.

One cannot but conclude that the graph points to a very serious depletion of the paradigm of economic development in Portugal in recent decades.

Our professor undoubtedly has the talent and ambition to have achieved such a qualified biography. It was hoped, however, that at least some of these qualities could spill over into the way he sees his own country as well, instead of resigning himself to being 30 years behind, as if resigned to living in an age where no there were no cell phones or internet, and in a country where only foreigners who settle here truly enjoy quality of life.

Unless, knowing the voluptuousness of government appropriation of economic analysis, publicly presenting our future as a smile is too naive to remain politically motivated.

Source: Observadora